That’s a good question! It’s always important to research the businesses you’re engaging with.

Here are some of our key pointers:

>> TRANSPARENCY – No Commission, no fees, no hidden nasties

We wouldn’t want them either. So, what you see is what you get.

>> BEST PRICE GUARANTEE – We will beat any local written quote by at least $1*

We know having the best rate possible means you get the most spending money overseas. That’s why we offer our Best Price Guarantee! Find the T&Cs here, but the gist is that if you give us a written quote, we’ll beat it by $1.

>> RATE MOVE GUARANTEE – Protection against rate fluctuations.

The rates can change quicker than Aussie weather. It can be stressful trying to guesstimate the right time to exchange money. Which is why we’ve built in protection! If you see the exchange rate gets better within 14 days of exchanging with us, we’ll refund you the difference.* Learn more.

>> CASH COMMITMENT – Always have top currencies in stock.

We’re not here to waste your time. There’s nothing more annoying than taking time out of your day to buy something and they don’t have stock. But we will ALWAYS have our top currencies in stock!

• United States Dollar (USD)

• Euro (EUR)

• Great British Pound (GBP)

• New Zealand Dollar (NZD)

• Japanese Yen (JPY)

• Thai Baht (THB)

• Singapore Dollar (SGD).

And if we don’t have the currency available in store? Well, we’ll give you up to $100*.

>> 60+ CURRENCIES – Pre-order rare currencies!

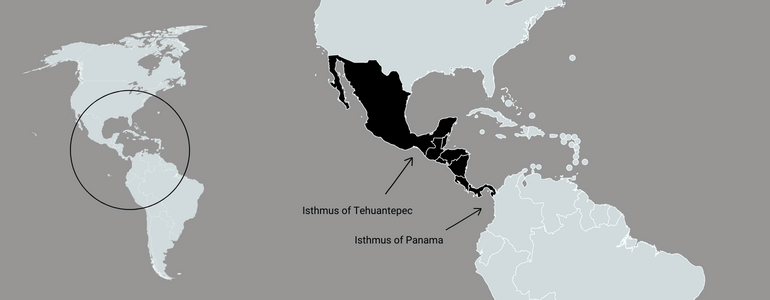

We also know that maybe you want to travel off the beaten path. Well, we stock over 60+ currencies! Head to your local Travel Money Oz store and ask a friendly expert what’s the best option for you. If it’s a rare currency that we stock, we should be able to get it in for you, or it might even be the case that it’s a currency you can only get in-destination, and another currency might get you better rates when you’re there (for example, Bolivian Boliviano – it’s better to take United States Dollars and trade once you’re in Bolivia!).

>> FRIENDLY WORLD EXPERTS – By travellers, for travellers!

Last but definitely not least, we’re experts in all things travel and money, and are travellers ourselves so we can give the best advice!

We’re in the business of travel money because we know and love travel, so we’re here to help make it all easier for you – especially first timers experiencing large sums of cash for the first time!

Come and have a chat with us in-store for your upcoming trip, we’d love to help out.

We also have these helpful blogs and World Currency Guides if you’re a bit more introverted and would rather learn online (don’t worry, we get it).

>> BUT DON’T JUST TAKE OUR WORD FOR IT – Read our reviews!

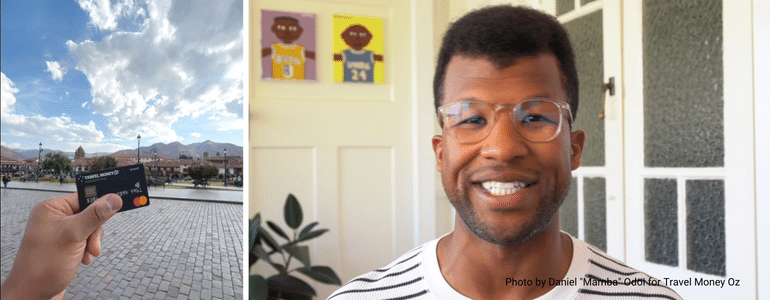

If you watched the Flight Centre YouTube video at the top of the page, Daniel also left this glowing Google review for our Travel Money Oz Myer Centre store:

★★★★★

Daniel Odoi

As I’m traveling to South America (Peru and Bolivia) for the first time and haven’t experienced having to exchange AUD for cash-heavy countries, Rebbecca from the Travel Money Oz Myer Centre left me feeling infinitely more confident in my understanding of their currencies, how the exchange process works and how to best approach my money situation while aboard. Her expertise, passion and thoughtfulness is world-class and she truly went above and beyond in answering all of my questions. I could not recommend her more highly and am so grateful to have her on my side as a fellow traveller that loves sharing her passion with others.

Pumped for my trip! @danielmambaodoi

Check out all our reviews on Google though, we’re really proud to have so much fantastic feedback from our amazing travellers!