There are a few key ways every traveller can maximise their holiday kitty. Understanding the metrics at play when it comes to forecasting AUD to IDR is one of these ways. While the process itself can be quite convoluted, we have created a beginner’s guide to forecasting the IDR. That way, with a little bit of foresight and planning, you can maximise your spending money overseas.

We do, however, understand that you might be too busy working on your perfect holiday bikini body to keep an eye on rates, so we recommend signing up for rate alerts and letting us do the hard work for you.

Check out the below table as an example. We analysed 68 different bank forecasts to see what the IDR to AUD forecast is for the next 2 peak travel periods.

AUD to IDR Exchange Rate Forecasts:

|

AUD/IDR

|

Mean (of 68 bank forecasts)

|

Citigroup

|

Westpac

|

|

Seasonality

|

Q2 2020

|

Q3 2020

|

Q2 2020

|

Q3 2020

|

Q2 2020

|

Q3 2020

|

|

Exchange Rate

|

9,717

|

9776

|

9,881

|

10108

|

9,438

|

9560

|

|

Exchange 2k in AUD

|

19,434,000

|

19,552,000

|

19,762,000

|

20,216,000

|

18,876,000

|

19,120,000

|

|

Difference

|

IDR 118,000

|

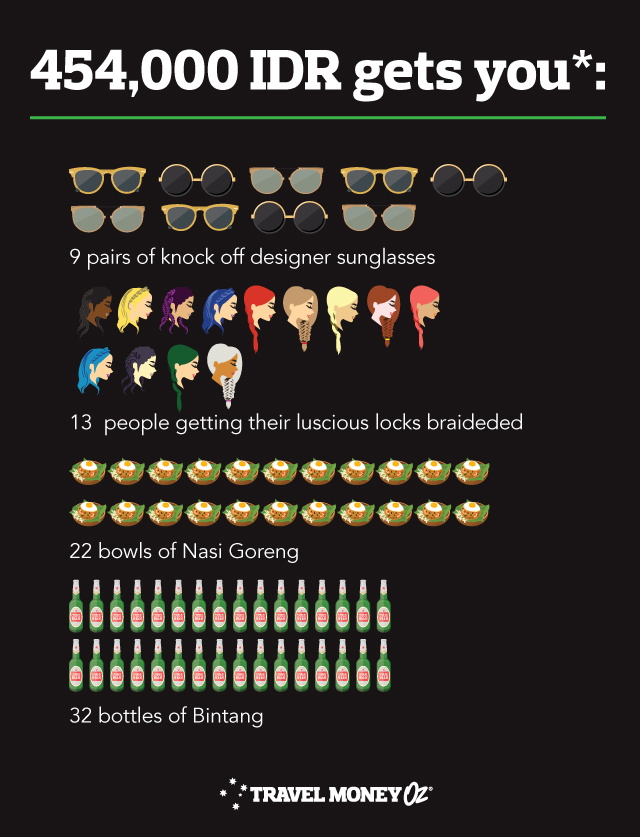

IDR 454,000

|

IDR 244,000

|

|

Data correct as of 11 February 2020.

|

Too many numbers, what does this mean for me though? Well, lets use Citigroup as an example.

Not bad, hey? A little bit of planning can leave you well fed and looking fab.

If you’re thinking “Yeah cool, I still don’t understand 1. How they made these predictions and 2. Why there are so many zeros in Indonesian currency?” To answer your questions:

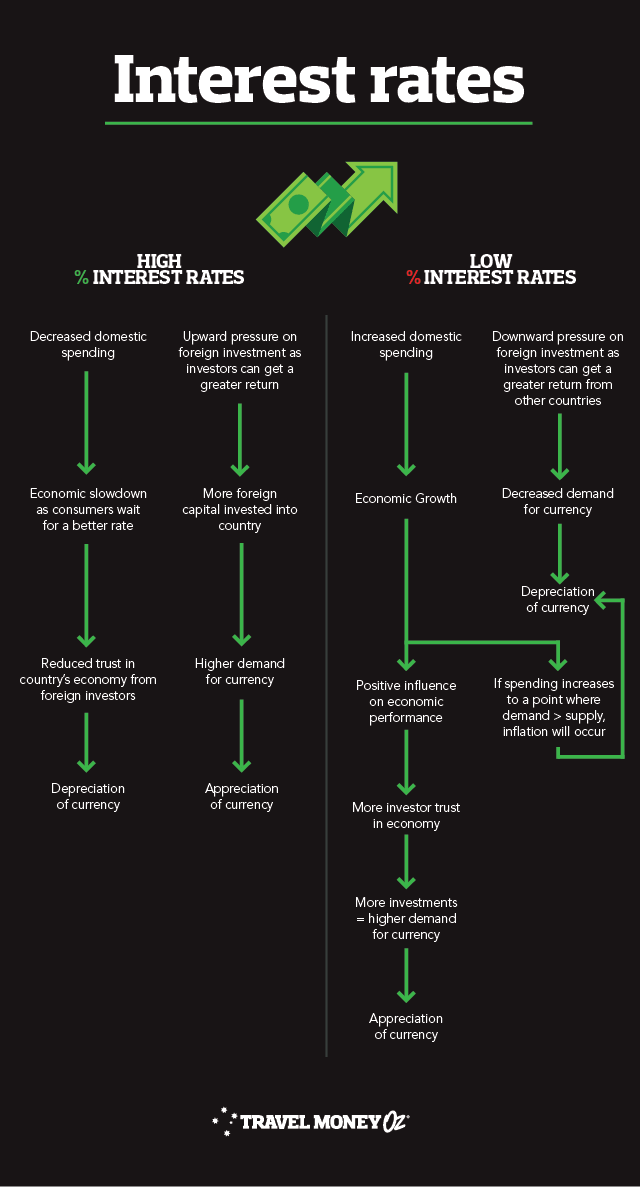

1. There is no simple answer as to how banks came to these predictions. Banks and financial institutions compile and analyse a large scope of information sources that encapsulate countless streams of data. Still, none of these methods are fool proof, and unless the banks can suddenly start predicting the future, a prediction is simply that – a prediction.

If you are happy relying on the banks it’s definitely worth checking out a few predictions to give yourself the most well rounded view. If, however, you like a bit of DIY, the most traveller friendly way of understanding forecasts is to look at the relationship between macroeconomic fundamentals and exchange rates.

2. In a word, depreciation. You’ll read more about it below.

Dip your toes in the water with these definitions first.

Appreciation: When the value of one currency increases relative to another. E.g. If the AUD went from 10,544 IDR to 10,713 IDR, it has appreciated (more poolside cocktails in Seminyak for you).

Depreciation: Surprise, surprise: this is when the value of a currency decreases relative to another. E.g. If the AUD went from 10,713 IDR to 10,544 IDR, it has depreciated (swap the cocktails for a Bintang, sadly you have less cash to splash).

Higher valued currency: cheaper imports (that Balinese hut for your backyard oasis is cheaper), more expensive exports and extra spending money for those beachside massages in Kuta.

Lower valued currency: more expensive imports, cheaper exports (and more tourists in Australia) and less cash for your Indonesian Island hopping adventure.

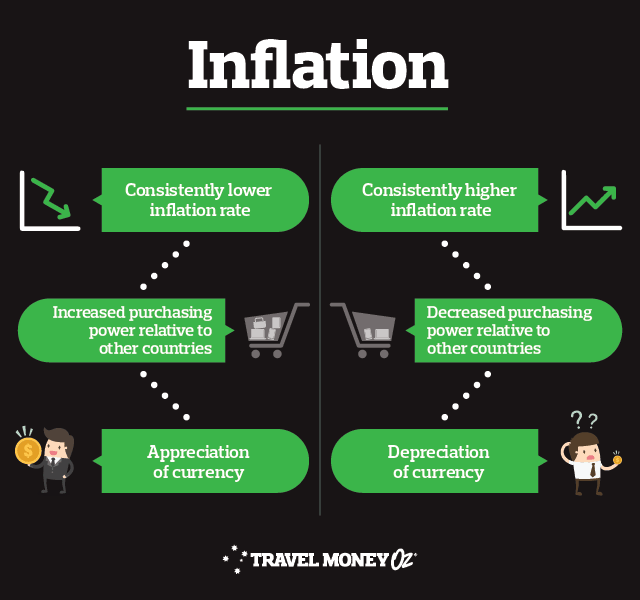

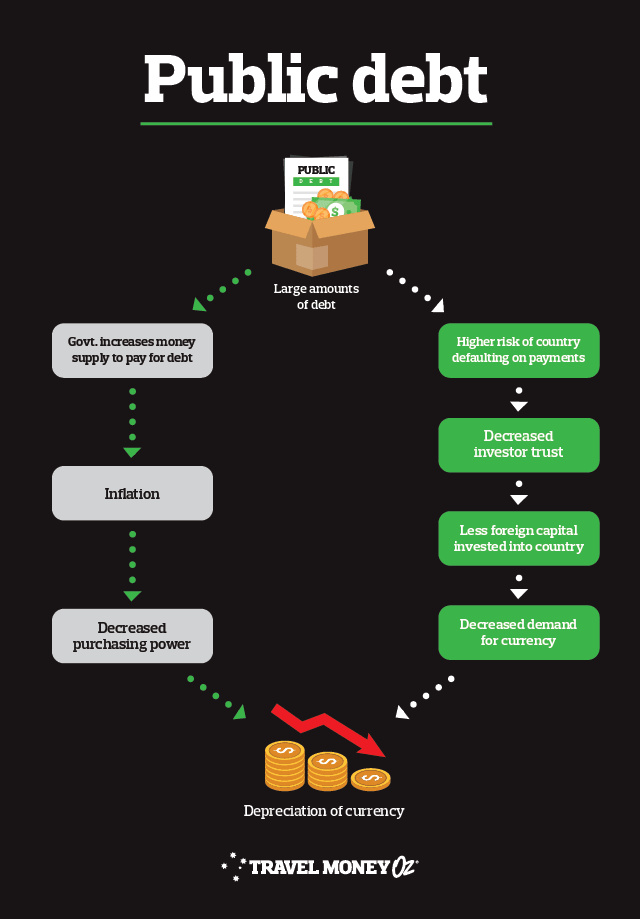

Inflation: The rate at which the general level of prices for goods and services is rising and, in turn, a currency’s purchasing power is falling. In other words, $10 back in the day used to get you a lot more than it does now. Generally, over time the value of a currency decreases as a result of supply and demand.

Economic growth: The increase in an economy’s capacity to produce goods and services. Growth is generally good, but we don’t want it to be too fast. Good growth is like when you’re working on your beach bod, pumping it out on the treadmill with your favourite running playlist on in the background. Bad growth is when your PT knocks the speed up to 16, screamo starts playing in the background and you suddenly lose control of your legs (bad experience, I don’t want to talk about it).

With these under your belt, check out the following.

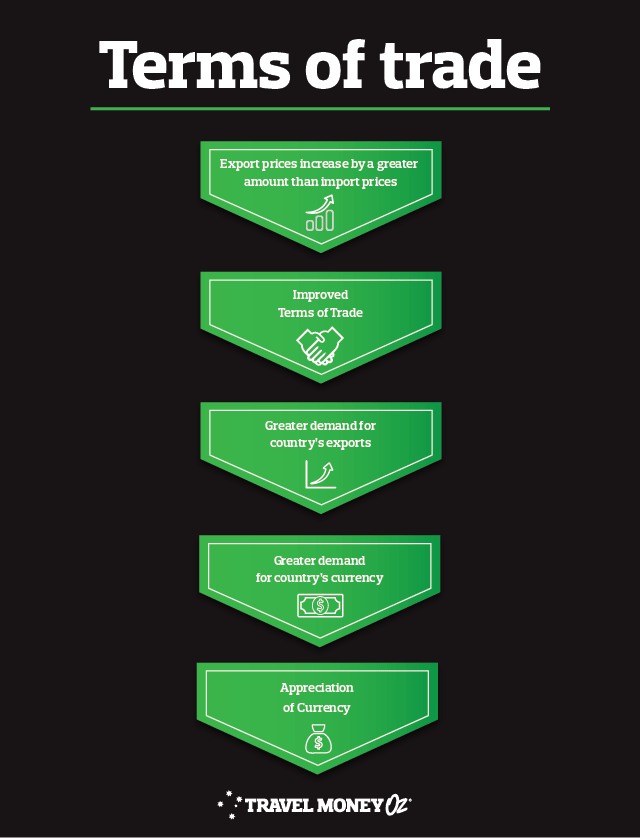

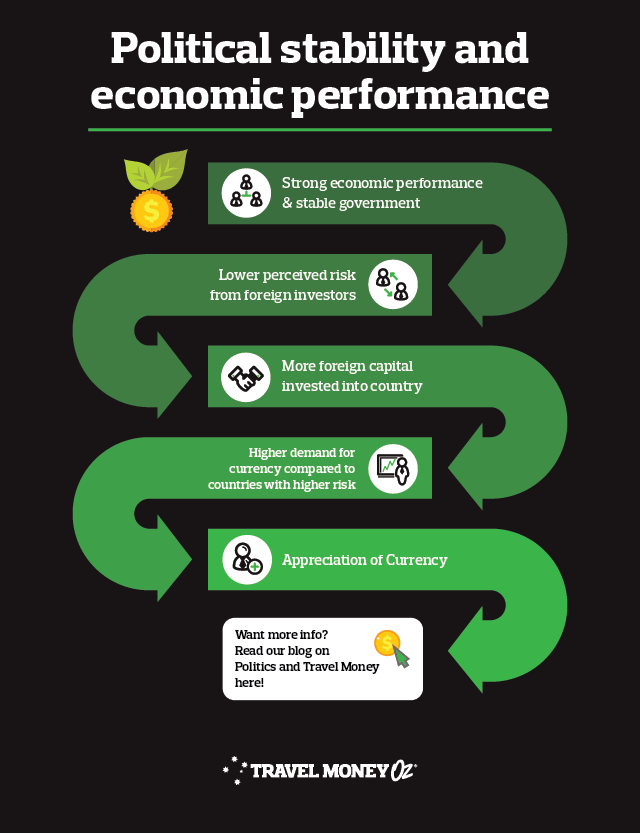

As we said earlier, AUD to IDR exchange rates are influenced by a bunch of factors. If you are overwhelmed, just try and remember that exchange rates sum up the supply and demand of a currency in an easy to measure metric. This demand is driven by people’s perception of the currency’s value. This perception alone is influenced by economics, politics and the media (just to name a few). See why the banks need to analyse so much data? It’s heavy stuff.

For those playing at home, it is also important to remember that changes to the IDR are relative to changes in the AUD (and the Australian economy as a whole). All elements interact and influence each other separately, so they must be considered all together and aligned with both countries to get a truly holistic view

The Indonesian Rupiah is a great example of how a number of macroeconomic factors have led to pretty full on depreciation.

While we may look back on the late 90’s with fond memories of acid wash denim and eclectic dance beats, the IDR looks back at a time of severe currency depreciation. This came as a result of a number of factors, particularly the Indonesian government encouraging devaluation to stimulate exports prior to 1997, high inflation and a large account deficit. Around this time, the Indonesian government also abandoned control over the market and left it to float freely with the mechanism (Wow that sounds complicated. Please give me more information).

This rapid depreciation is why you will find yourself paying a few thousand Rupiah for a meal. If you want to walk around with a few million in your back pocket, Indonesia is definitely the place to go (but also maybe don’t do that because of safety, please).

The IDR and Indonesian economy is still battling a pretty wide account deficit (they did one too many afterpay’s and have a fair bit of debt), high inflation and slowing economic growth. Not to mention that foreign investors hold almost 40% of Indonesian government bonds, putting the country in a precarious position as they are incredibly vulnerable to the mood swings of foreign investors.

Whilst this isn’t great for Indonesia, it is working in the favour of the countless Aussie travellers heading over for a Bali holiday every year. It is definitely worthwhile keeping an eye on what is going on with the IDR so you arrive overseas with some extra spending money in your back pocket.

If you are already in holiday mode and the above blog has bored you to tears, just sign up for currency alerts and let us do the hard work for you. There’s no need to stress about missing out on a better rate after your foreign exchange purchase either. Attach Rate Move Guarantee in store and we will refund you the difference should the rate change within 14 days of purchase. I’ll cheers to that deal.

*Prices are approximations based of the difference between mean estimates for AUD to IDR in Q2 2020 and Q3 2020. Keep in mind prices may vary across states and individual vendors. Cost and quantity estimations should be used as a guide only. This blog is provided for information only and does not take into consideration your objectives, financial situation or needs. You should consider whether the information and suggestions contained in any blog entry are appropriate for you, having regard to your own objectives, financial situation and needs. While we take reasonable care in providing the blog, we give no warranties or representations that it is complete or accurate, or is appropriate for you. We are not liable for any loss caused, whether due to negligence or otherwise, arising from use of, or reliance on, the information and/or suggestions contained in this blog.