This, coupled with NZ’s proximity and awesome travel deals, means Aussie’s froth on the opportunity to visit our friends across the ditch.

Despite the AUD often being stronger than the NZD, we can still witness large currency fluctuations that dramatically influence the amount of Kiwi cash we take on holiday. A key example of this can be seen in early 2019. On January 21st, exchanging $2,000 AUD would have gotten you $2,054.80 NZD. Exchanging the same amount on February 14th, less than one month later, left you with $2,006 NZD - a huge difference of $48.80. That’s a lot of fush ‘n’ chups.

To give you an idea of how the AUD/NZD cross could perform throughout 2020, we compiled some bank forecasts below.

AUD to NZD Exchange Rate Forecasts:

|

AUD/NZD

|

Mean (of 68 bank forecasts)

|

Citigroup

|

Westpac

|

|

Seasonality

|

Q2 2020

|

Q3 2020

|

Q2 2020

|

Q3 2020

|

Q2 2020

|

Q3 2020

|

|

Exchange rate

|

1.07

|

1.07

|

1.09

|

1.11

|

1.06

|

1.06

|

|

Exchange 2k in AUD

|

$2,140

|

$2,140

|

$2,180

|

$2,220

|

$2,120

|

$2,120

|

|

Difference

|

$0

|

$40

|

$0

|

|

Data correct as of 11 February 2020.

|

As far as the banks are concerned we are in for a pretty steady few months. Alas, the global currency market is a pretty unpredictable beast, especially when you consider how turbulent the world’s geopolitical climate can be.

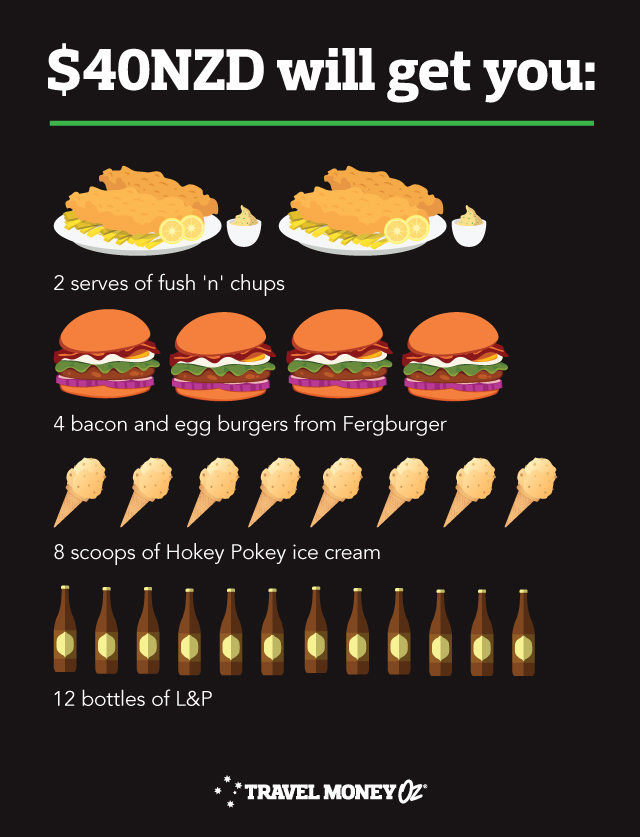

Should the banks be right with their predictions, we’re looking at a max difference of about $40 NZD. Might not sound like much, but $40 can get you:

Honestly, I don’t know who would turn down a few extra scoops of ice cream. You’re on holiday after all. Sign me up for the extra $40 now, please.

Speaking of signing up, did you know you can join the

Travel Money Club? By joining you go in the draw to win $500 each month. That’s 100 scoops of ice cream, and 100 reasons to join the club ASAP.

So, what if things run a bit differently than the banks suggest, and we end up with bigger fluctuations. How can you, the humble traveller, know the best time to buy your NZD? By forecasting of course!

This is, as you would expect, far easier said than done. Banks and financial institutions grab data from a multitude of sources when undertaking Australian dollar to NZD predictions. As you can imagine, the methodology used to turn this data into forecasts is by no means concrete, so we recommend checking a few sources of information to get a better idea.

Banks, schmanks though right. Why should they have all of the forecasting fun? With a little bit of reading and the occasional glance at the news, Aussie travellers can gain a pretty strong understanding of the dynamics underpinning fluctuations in the value of the AUD against the Kiwi dollar. The first step is to get an understanding of macroeconomic FUNdamentals and their influence on exchange rates.

Macroeconomics 101

Appreciation: When the value of one currency increases relative to another. E.g. If the AUD went from 1.003NZD to 1.0274NZD it has appreciated (you will appreciate the extra ice cream that you’ll get as a result).

Depreciation: This is when the value of a currency decreases relative to another. E.g. If the AUD went from 1.0274NZD to 1.003NZD it has depreciated. (Like seagulls stealing your hot chips, depreciation only brings sorrow).

Higher valued currency: cheaper imports (no more abandoning that online shopping cart), more expensive exports and extra spending money for your Kiwi adventure.

Lower valued currency: more expensive imports, cheaper exports (you’ll see more UGG boots in NZ) and less cash for you to spend on bungy jumping in Queenstown.

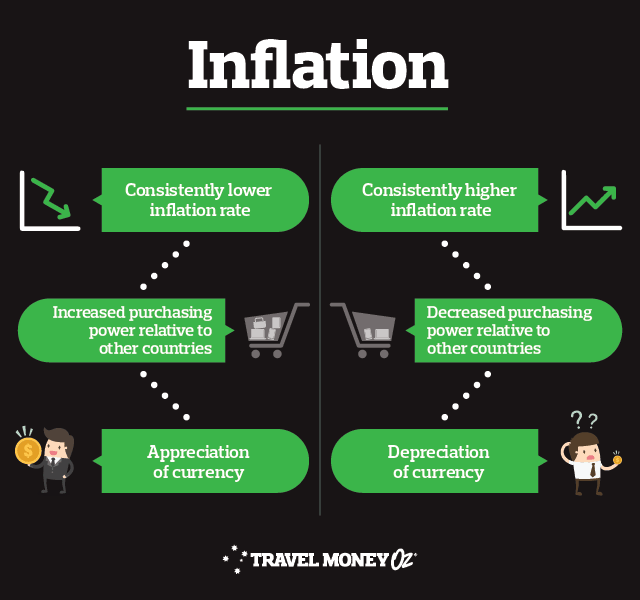

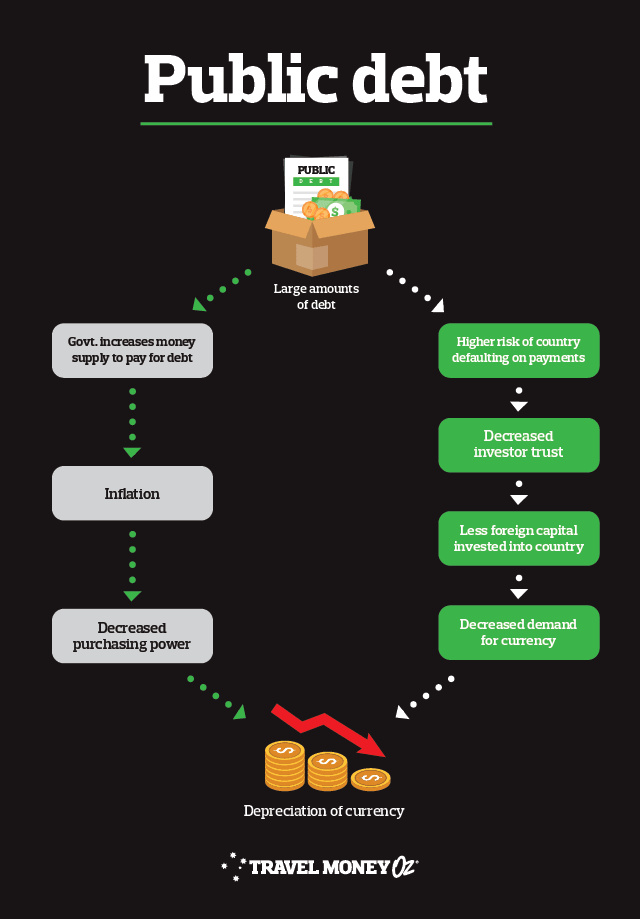

Inflation: The rate at which the general level of prices for goods and services is rising and, in turn, a currency’s purchasing power is falling. Key example: $5 used to buy our grandparents seven chocolate bars, three new pairs of undies and a pet parrot. Now it barely gets us a Happy Meal.

Economic growth: The increase in an economy’s capacity to produce goods and services. Growth is generally good, but we don’t want it to be too fast. Good growth is like the adrenaline you feel from a bungee jump. Bad growth is the equivalent of getting rammed by a sheep in a paddock. Ouchies.

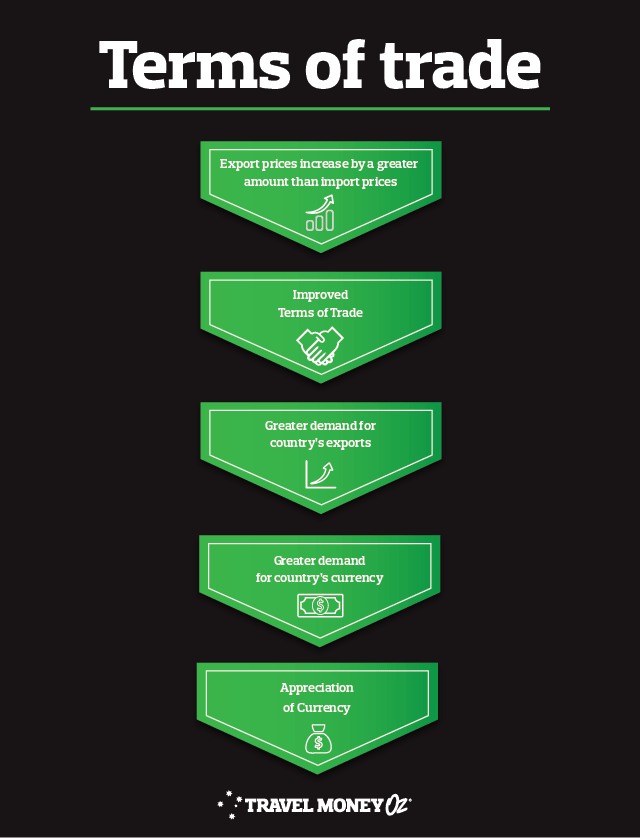

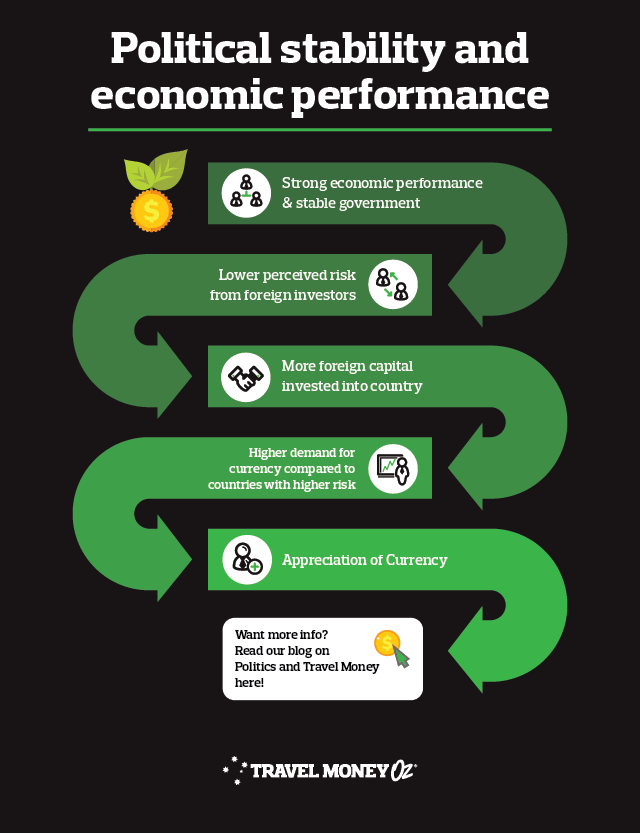

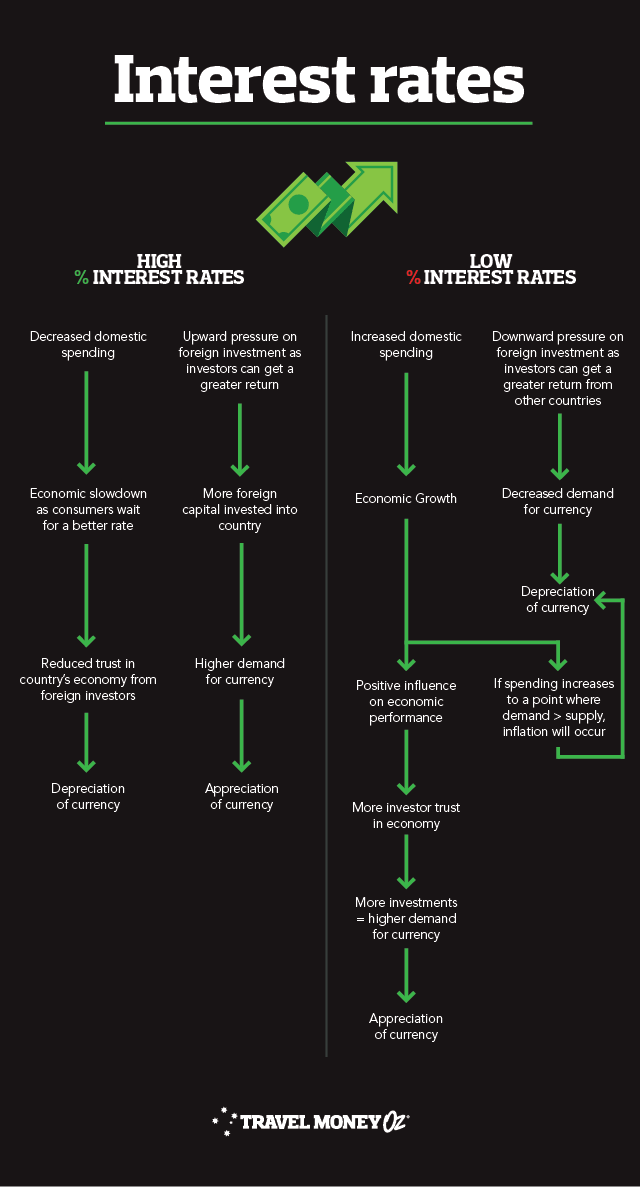

Now that you’ve mastered those concepts, let’s check out some flow charts.

Feeling smart yet? We’re almost there, I promise.

When you take all of these factors into account, it’s important you also consider the following:

- There is A LOT of things, big and small, that impact the value of the currency. As you can imagine, this can become rather complicated. With this in mind, the simplest way to view exchange rates is at their most fundamental level – they are easy to measure metrics the sum up the supply and demand of a currency. If more people want to buy Australian goods or visit Aussie shores, there will be a higher demand for our currency, thus increasing its value. The same happens in reverse.

- Market psychology, or people’s perception of a currency’s worth, is a key driver of demand. This perception is influenced by economics, the media and politics (among other things). If people think the USA is going to increase interest rates, the value of their currency could very well increase as a result.

- A change in one currency is always relative to a change in the currency of that it is being compared to. Therefore, a change in the AUD compared to the NZD is impacted by both countries economic and political climates. You need to have a scope of both before getting an accurate understanding of exchange rate movements.

Feeling overwhelmed yet? We don’t blame you. Grab some ice cream to enjoy as you remember these key principles.

Consumer sentiment is key. The more confidence investors have in an economy the better. Events such as Brexit, terrorism and trade agreements can have a major effect on consumers’ confidence in both the country and the currency.

More trust = more people willing to invest in country = greater demand for currency = appreciation

Less trust = less foreign capital invested into country = decreased demand for currency = depreciation

Take a bow. You’ve officially learnt a bit more about macroeconomics and, hopefully, have a better understanding of what influences exchange rates.

With this in mind, if you got to the end of the article and really can’t be bothered with all the hard work (we don’t blame you, to be honest), simply sign up for

currency alerts. We’ll do all the hard work and let you know when the NZD hits your preferred rate.

Don’t forget to add

Rate Move Guarantee to your transaction in store as well. It’s free and will protect you against exchange rate movements within 14 days of purchase^.