If you exchanged 2000 AUD to VND on January 27, 2018, you would have banked an extra 4,735,240 dong then if you had traded the same amount a year later on January 3, 2019. Yes, that's almost an additional five million VND or about 315 Banh mi for exchanging currency a year earlier.

Now, unless you're an expert planner, it's unlikely you're buying your foreign currency a year in advance. We get that. However, even the space of three or four months can see foreign exchange fluctuations that will have a considerable impact on your spending money overseas.

You can try and maximise your travel money by having a crack at Australian dollar to Vietnamese dong forecasts. I know, sounds pretty wild, right?

Before you slam the laptop shut and admit defeat at the thought of exchange rate forecasting, I beg you to think of the extra banh mi's you can indulge in. A little hard work (not too hard, we promise) now means you can indulge in more pho's or even an extra few nights in Vietnam by maximising on the strength of the Aussie dollar.

Straight up, we don't expect you to become an economics master. Instead, you just need a simple understanding of macroeconomics and an idea of what is happening around the world.

Before we dive into the process, let's take a look at what major banks have forecast for the AUD to VND exchange rate for 2020.

AUD to VND exchange rate forecasts

|

AUD/VND

|

Mean

|

ANZ

|

United Overseas Bank

|

|

Seasonality

|

Q2 2020

|

Q4 2020

|

Q2 2020

|

Q4 2020

|

Q2 2020

|

Q4 2020

|

|

Exchange Rate

|

15,850

|

15,995

|

15,345

|

15,378

|

16,146

|

16,450

|

|

Exchange 2k in AUD

|

31,700,000

|

31,990,000

|

30,690,000

|

30,756,000

|

32,292,000

|

32,900,000

|

|

Difference

|

290,000

|

66,000

|

608,000

|

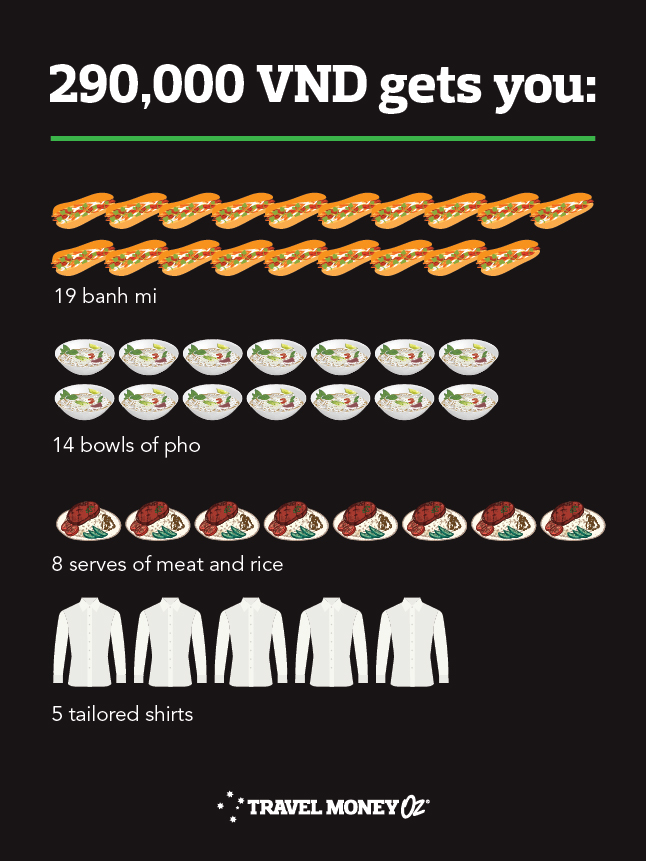

As you can see, the Aussie dollar is expected to gain in value against the Vietnamese dong later in 2020. If we take the mean as an example, holding off and purchasing in the latter part of the year could get you a fair bit.

In other words, a brand new outfit or two, or your meals for a few days. Does forecasting seem kinda worthwhile now?

How do banks reach these forecasts?

Banks and financial institutions draw on a broad scope of data sources when completing AUD to VND predictions. The sheer volume of the data analysed, and the varying number of data streams means no method is foolproof enough for economists to rely on solely. With this in mind, consult a few forecasts to get the most well-rounded view.

The most traveller-friendly way of understanding the metrics behind these predictions is to learn about the relationship between macroeconomic fundamentals and exchange rates. Sounds scary, but we promise it's not. The following information will have you well on your way to not only impressing your friends at trivia but also ensuring you're equipped with the knowledge needed to maximise your travel money.

Let's start with a few key definitions.

Appreciation: When the value of one currency increases relative to another. E.g. If the AUD went from 15,850 VND to 15,995 VND it has appreciated. You'll appreciate the extra serves of spring rolls as a result!

Depreciation: You guessed it, this is when the value of currency decreases relative to another. E.g. If the AUD went from 15,995 VND to 15,850 VND it has depreciated. Less spring rolls and more sadness.

Higher valued currency: cheaper imports (no more abandoning that online shopping cart), more expensive exports and extra VND to spend on a Mekong River cruise.

Lower valued currency: more expensive imports, cheaper exports and less VND for your adventure.

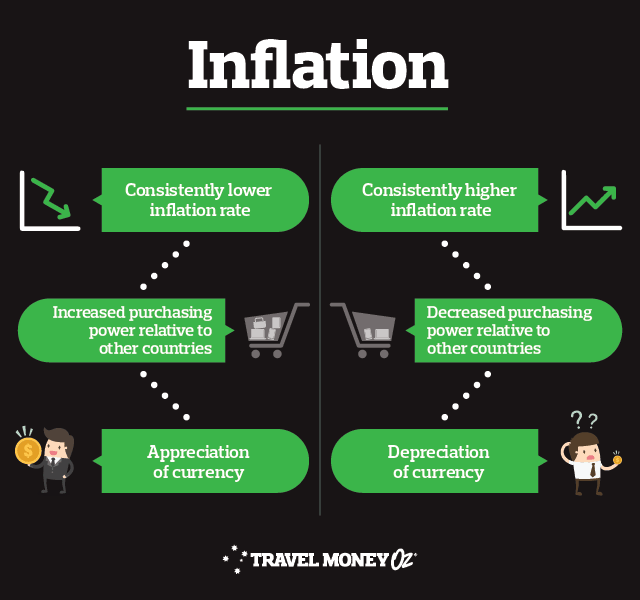

Inflation: The rate at which the general level of prices for goods and services is rising and, in turn, a currency's purchasing power is falling. In other words, $10 back in the day used to get you a lot more than it does now - over time, the value of a currency decreases as a result of supply and demand.

Economic growth: The increase in an economy's capacity to produce goods and services. Growth is generally good, but we don't want it to be too fast. Good growth is finding the perfect street vendor for all of your Vietnamese food dreams. Bad growth is like biting into some nasty street meat and spending the next few days hugging the toilet seat. Egh. You get the gist.

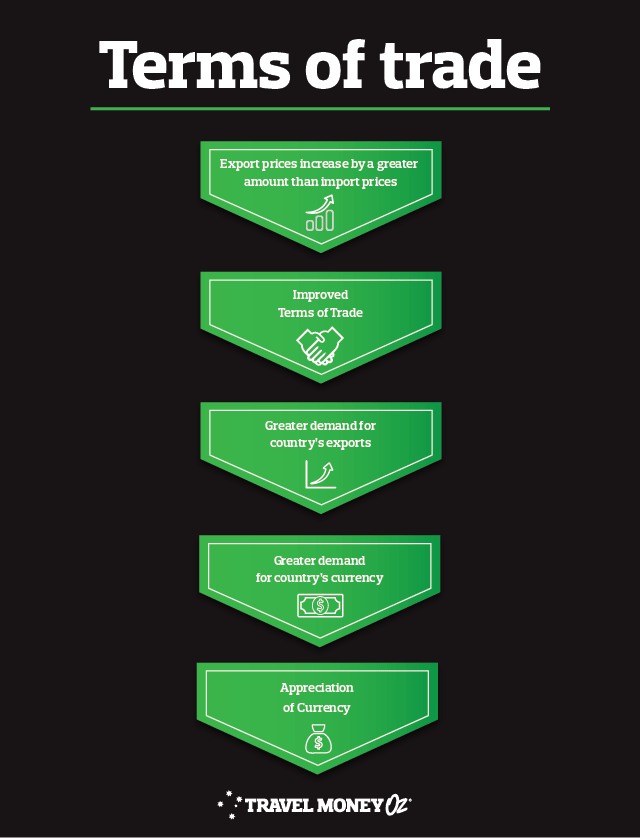

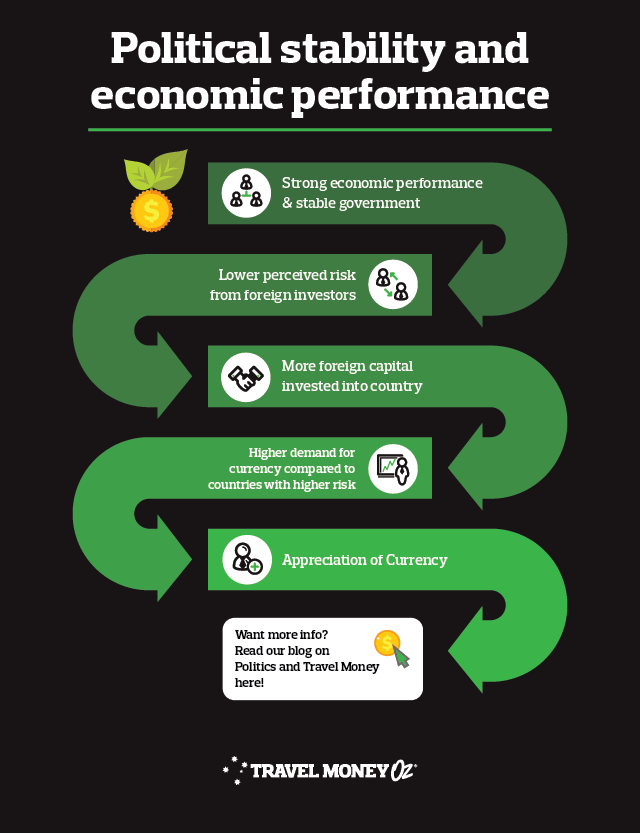

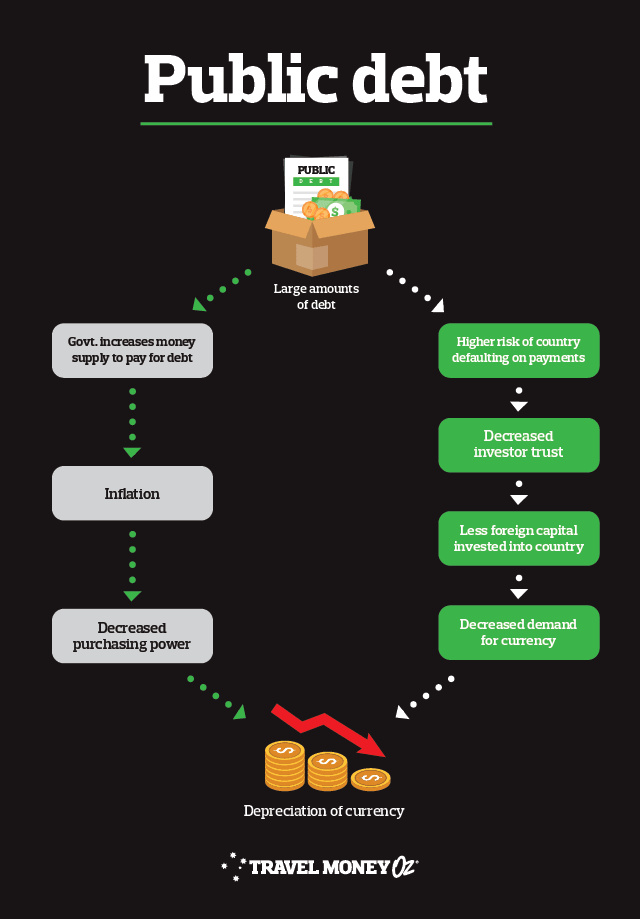

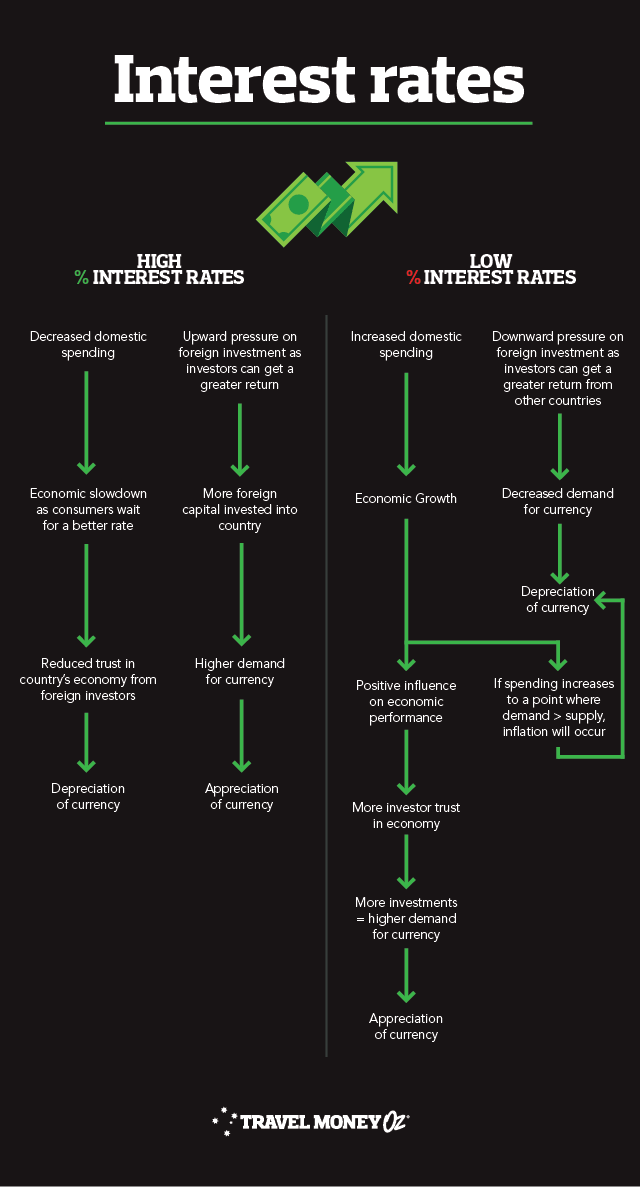

Now you've got those under your belt, check out these infographics.

As you can see, AUD to VND exchange rates are influenced by quite a few factors. If your head is swimming with information overload, try to remember that, ultimately, exchange rates sum up the supply and demand of a currency in an easy to understand metric.

Actual demand is also highly influenced by the general market perception of the currency's value. Like most things, this perception is formulated by economics, politics and the media.

It is also crucial to remember that changes in one country must be measured against changes in the comparison country. All elements interact and influence each other separately, so they need to be considered holistically to get a true understanding of what is going on.

If you're still struggling to wrap your head around the whole thing, just remember currency follows the rules of supply and demand:

More trust = more people willing to invest in country = greater demand for currency = appreciation

Less trust = less foreign capital invested into country = decreased demand for currency = depreciation

From a traveller's perspective, we don't have a great deal of control over how the AUD will perform against the Vietnamese dong. However, a little bit of knowledge and pre-planning can leave you with some more spending money in your back pocket. Better yet, sign up for currency alerts and let us do the hard work for you.

Don't stress about missing out on a better rate after purchase either! Attach Rate Move Guarantee in store and we will refund you the difference should the rate change within 14 days*.

*Prices are approximations based on the difference between mean estimates for AUD to VND in Q2 and Q4 2020. Keep in mind prices may vary across states and individual vendors. Cost and quantity estimations should be used as a guide only.This blog is provided for information only and does not take into consideration your objectives, financial situation or needs. You should consider whether the information and suggestions contained in any blog entry are appropriate for you, having regard to your own objectives, financial situation and needs. While we take reasonable care in providing the blog, we give no warranties or representations that it is complete or accurate, or is appropriate for you. We are not liable for any loss caused, whether due to negligence or otherwise, arising from use of, or reliance on, the information and/or suggestions contained in this blog.Terms and conditions apply to Rate Move Guarantee. See in store or online for more details.