The euro isn’t a super volatile currency, which is good news for travellers and European citizens alike. However, it still sees fluctuations that can impact your travel money.

Check out the below table that outlines some forecasts for the next two peak travel seasons.

AUD to EUR Exchange Rate Forecasts:

|

AUD/EUR

|

Mean (of 68 bank forecasts)

|

Citigroup

|

Westpac

|

|

Seasonality

|

Q2 2020

|

Q3 2020

|

Q2 2020

|

Q3 2020

|

Q2 2020

|

Q3 2020

|

|

Exchange rate

|

0.6

|

0.61

|

0.64

|

0.63

|

0.62

|

0.63

|

|

Exchange 2k in AUD

|

€1200

|

€1220

|

€1280

|

€1260

|

€1240

|

€1260

|

|

Difference

|

€20

|

€20

|

€20

|

|

Data correct as of 7 February 2020

|

So, good news for Aussie travellers is that AUD to EUR forecasts don’t predict a whole lot of fluctuations in the next year or so. In saying that, €20 is €20 and no one is gonna turn down the opportunity to get some bonus cash (or croissants).

Sign me up now please. Speaking of signing up, did you know that you can join the Travel Money Club?

The Euro is the sole currency of 19 countries, so we can understand why you say ‘Mi Scusi’ at the prospect of forecasting its movements against the AUD.

Don’t stress, unless you are an economist or dabble in economic analysis as one of your hobbies, you are welcome to leave the forecasting to the banks.

Banks and financial institutions analyse data from a multitude of sources when undertaking Australian dollar to Euro predictions. The methodology that is then used to turn this data into predictions is by no means concrete, so it is generally a good idea to check a few forecasts for a well-rounded idea.

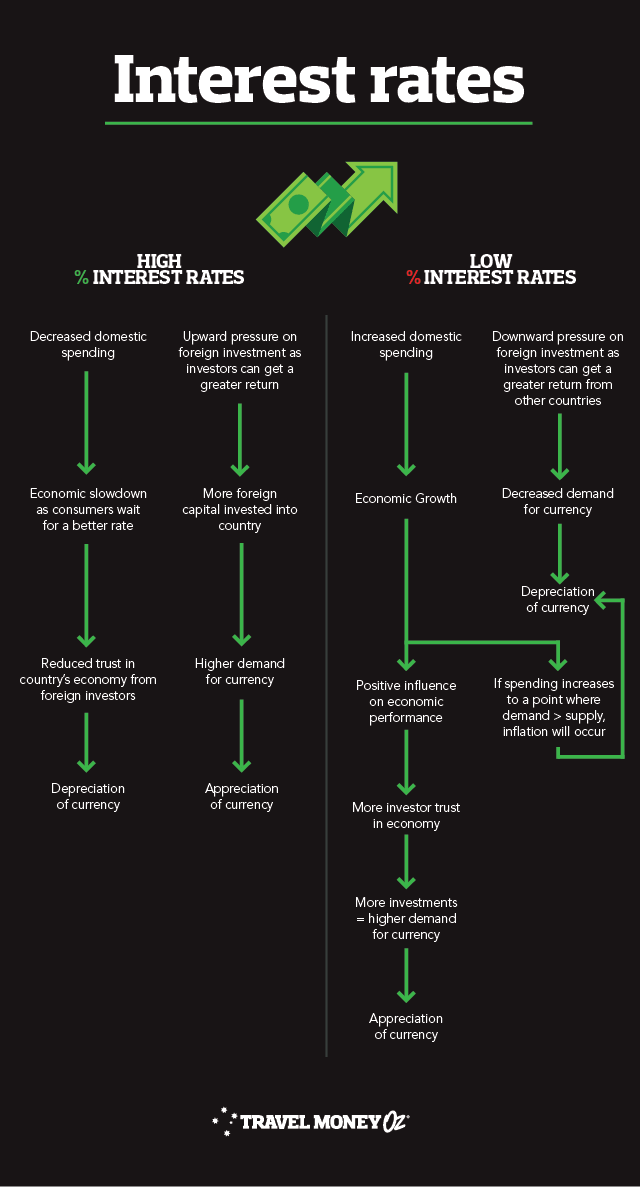

Don’t let the banks have all the fun though (this may or may not be sarcasm depending on how number-happy you are). With a little bit of reading and the occasional check of the news, Aussie travellers can understand the dynamics behind Australian dollar to euro forecasts. You just have to nail an understanding of how macroeconomic fundamentals influence exchange rates.

Let’s start off with the basics.

Appreciation: When the value of one currency increases relative to another. E.g. If the AUD went from 0.63EUR to 0.64EUR it has appreciated (get your sweatpants and get ready to fit in a few more croissants).

Depreciation: This is when the value of a currency decreases relative to another. E.g. If the AUD went from 0.64EUR to 0.63EUR it has depreciated. (Fewer croissants but maybe this could lead to a better beach bod? I dunno, I’d be sad about the lack of pastry).

Higher valued currency: Cheaper imports (no more abandoning that online shopping cart), more expensive exports and extra spending for your Euro trip.

Lower valued currency: more expensive imports, cheaper exports (more fashionistas in Milan wearing UGG boots) and less cash for your European summer escape.

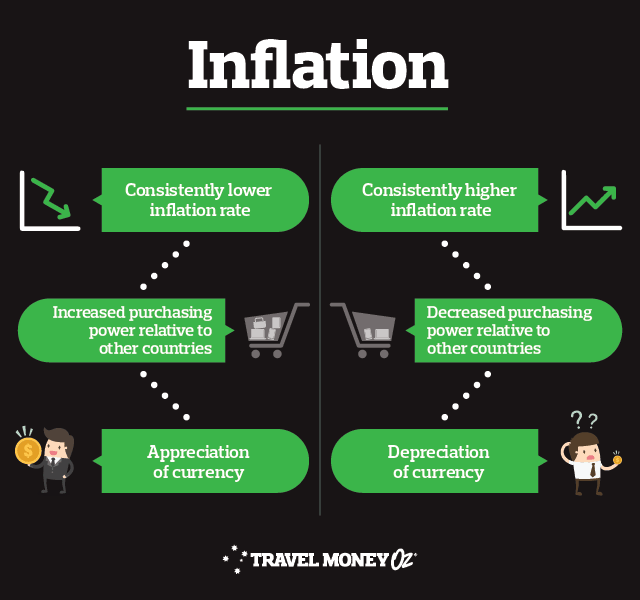

Inflation: The rate at which the general level of prices for goods and services is rising and, in turn, a currency’s purchasing power is falling. In other words, $10 used to get your mum and dad a lot more then it gets us.

Economic growth: The increase in an economy’s capacity to produce goods and services. Growth is generally good, but we don’t want it to be too fast. Good growth is the equivalent of a well-paced, 5 course long lunch on the French Riviera. Bad growth is like eating 3 brownies in Amsterdam before downing 3 cones of those delicious chips and passing out in the gutter from a food coma.

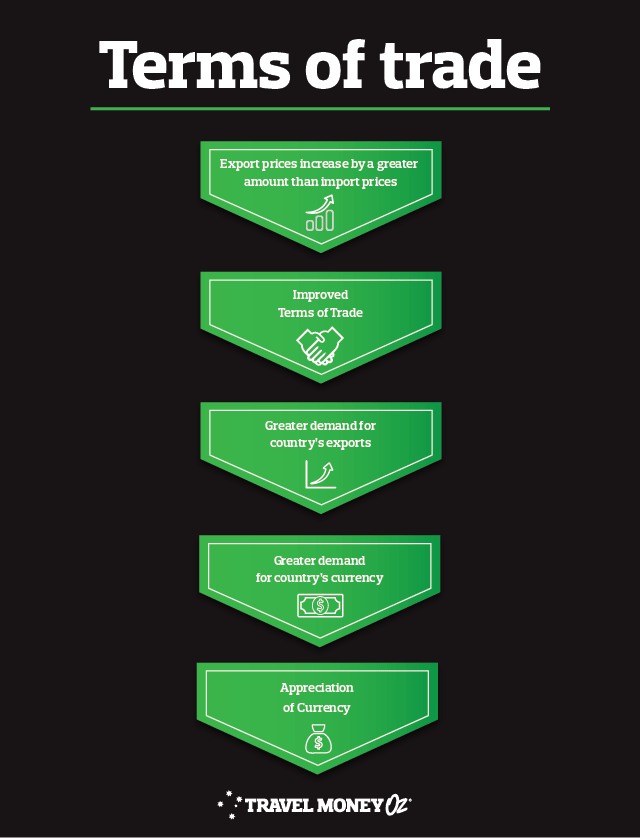

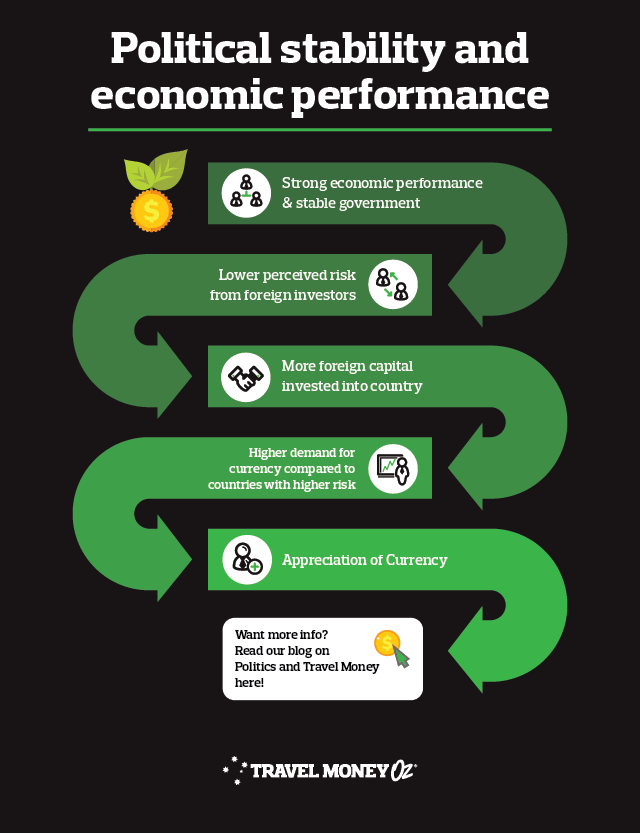

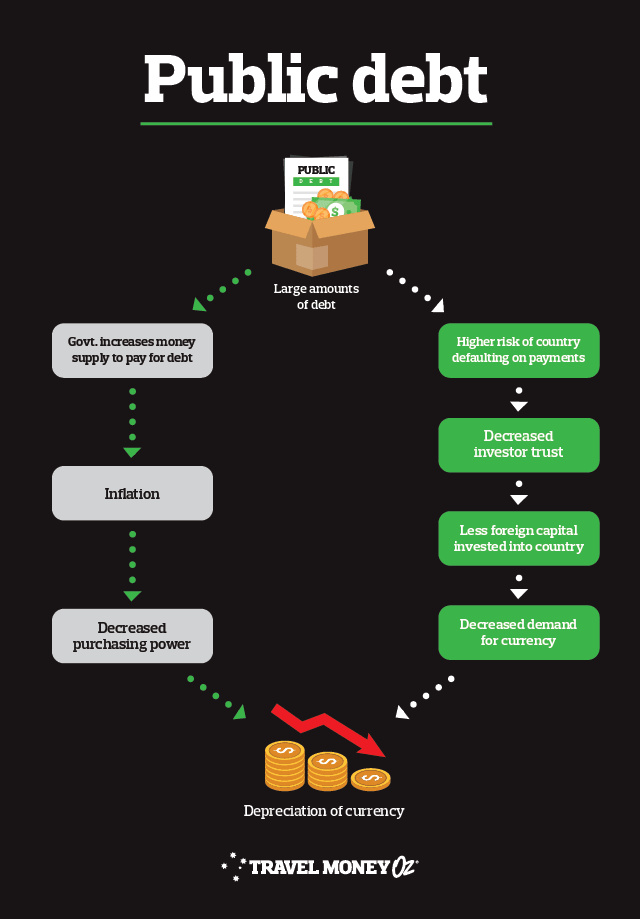

Now we’ve got those covered. Check out these flow charts.

Finally, the cherry on top of this information pie – when looking at these factors it’s important to also consider the following:

- Just like Europe, there are a number of elements that interact and influence each other internally to impact exchange rates. These can get pretty complicated. The simplest way to view exchange rates is at their most fundamental level – they are an easy to measure metric that sum up the supply and demand of a currency.

- Market psychology, or people’s perception of a currency’s worth, is a key driver of demand. This perception is influenced by economics, the media and politics (among other things).

- A change in one currency is relative to a change in the currency of which it is being compared to. E.g. A change in the Euro against the AUD is not just impacted by the European economic climate, but also everything that is going on in Australia. You must have a scope of both countries to get an accurate understanding or exchange rate movements.

Of course, with so many individual economies and political systems at play with the Euro, such a scope can be incredibly overwhelming. So, if all else fails and this is becoming a bit too much for your pre-holiday brain (we don’t blame you), just try and remember the following.

Consumer sentiment is key. The more confidence investors have in an economy the better. Events such as Brexit, terrorism and trade agreements can have a major effect on consumers’ confidence in both the country and the currency.

More trust = more people willing to invest in country = greater demand for currency = appreciation

Less trust = less foreign capital invested into country = decreased demand for currency = depreciation

If you are planning a Euro trip and simply don’t have time to monitor the comings and goings of 19 different economies (20 including Australia), don’t stress. Instead, leave the hard work up to us and sign up for currency alerts. You can also attach Rate Move Guarantee to your AUD to EUR exchange, so if the exchange rate improves within 14 days of your purchase we will give you the difference*.

At the end of the day, a little knowledge didn’t hurt anyone, except maybe when Mum and Dad told me Santa wasn’t real. Having an understanding of the aforementioned macroeconomic fundamentals, as well as keeping up with the news, not only makes you more valuable at trivia, but can help you leave with more travel money in your back pocket.

*Prices are approximations based of the difference between mean estimates for AUD to EUR in Q2 2020 and Q3 2020. Keep in mind prices may vary across states and individual vendors. Cost and quantity estimations should be used as a guide only. This blog is provided for information only and does not take into consideration your objectives, financial situation or needs. You should consider whether the information and suggestions contained in any blog entry are appropriate for you, having regard to your own objectives, financial situation and needs. While we take reasonable care in providing the blog, we give no warranties or representations that it is complete or accurate, or is appropriate for you. We are not liable for any loss caused, whether due to negligence or otherwise, arising from use of, or reliance on, the information and/or suggestions contained in this blog.