In March 2019, exchanging 2000AUD for ARS would have got you about 56,000 Argentine peso. Exchanging the same amount nine months later in December 2019 would have got you over 83,000, a whopping 27,000 ARS more. That’s an extra 150 beers, or 220 freshly baked empanadas. Crazy, hey?

Foreign currency and exchange rates are fickle, in that they change often and without us really knowing what's going on. At the time we can understand why rates change as they do, however no one has a crystal ball that says “don’t travel for another nine months because you’re missing out on 150 beers”. If you do have one, please let us know, it would make our lives a lot easier.

What we do know is that changing exchange rates can and will heavily impact your spending power overseas. While we can’t guarantee anything, it is definitely worth educating yourself on the metrics and influencing factors behind exchange rate forecasting so that you know the best time to travel and purchase your foreign currency.

Australian dollar to Argentine peso forecasting isn’t for the faint-hearted, especially when you consider how many factors contribute to exchange rate fluctuations. However, having an understanding of what impacts forecasts can help you maximise your overseas spending money.

We’ve compiled some forecasts below to give you an idea of what to expect if you’re planning a trip to Argentina soon.

AUD to ARS Exchange Rate Forecasts

|

AUD/ARS |

Mean (of 20 bank forecasts) |

ING |

Silicon Valley Bank |

|||

|

Seasonality |

Q3 2020 |

Q4 2020 |

Q3 2020 |

Q4 2020 |

Q3 2020 |

Q4 2020 |

|

Exchange rate |

50.16 |

52.6 |

48.3 |

51.8 |

45.56 |

47.61 |

|

Exchange 2k in AUD |

100,320 ARS |

105,200 ARS |

96,600 ARS |

103,600 ARS |

91,120 ARS |

95,220 ARS |

|

Difference |

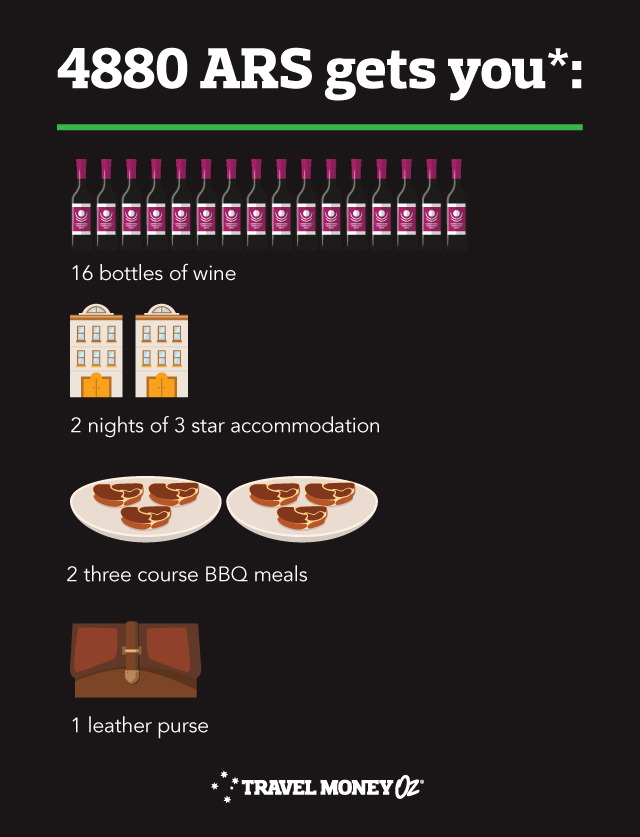

4,880 ARS |

7,000 ARS |

4,100 ARS |

|||

|

Data correct as of 2 March 2020. |

||||||

What does this mean though? Well, let’s take the mean as an example.

As you can see, the banks can’t seem to agree on what the AUD to ARS will do over the next little while. This is partly due to Argentina’s high rate of inflation, as well as weakness in both the Aussie and Argentinian economies and global factors at play.

How do banks forecast foreign currency movements?

The golden question. Short answer: they gain insight from a wide scope of information sources and make a prediction based on that. There is a multitude of data streams out there, and each financial institution has their own method of analysis. None of these are full proof though, so it’s worth considering a few AUD to ARS forecasts for a well-rounded view on when to purchase your travel money.

If you wanted a thorough understanding of the metrics behind the predictions, I would recommend you enrol in a university economics degree because that shiz is bananas. Alternatively, if you are just after a baseline understanding, we have thrown together a traveller friendly guide. At its core, you just need to get a solid understanding of the relationship between macroeconomic fundamentals and exchange rates.

Get started with a few key definitions.

Appreciation: When the value of one currency increases relative to another. E.g. If the AUD went from 50.16 to 52.6 ARS it has appreciated (this means more empanadas for you).

Depreciation: Surprise surprise, this is when the value of a currency decreases relative to another. E.g. If the AUD went from 52.6 to 50.16 ARS (less empanada and more sadness).

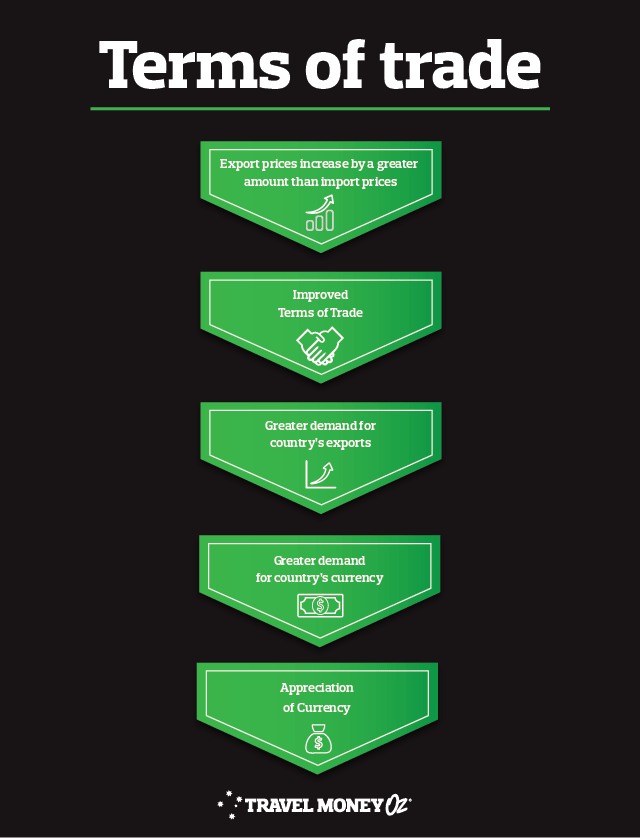

Higher valued currency: Cheaper imports (no more abandoning that online shopping cart), more expensive exports and extra spending money in Patagonia (the place not the shop).

Lower valued currency: More expensive imports, cheaper exports and less cash for your Argentinian adventure.

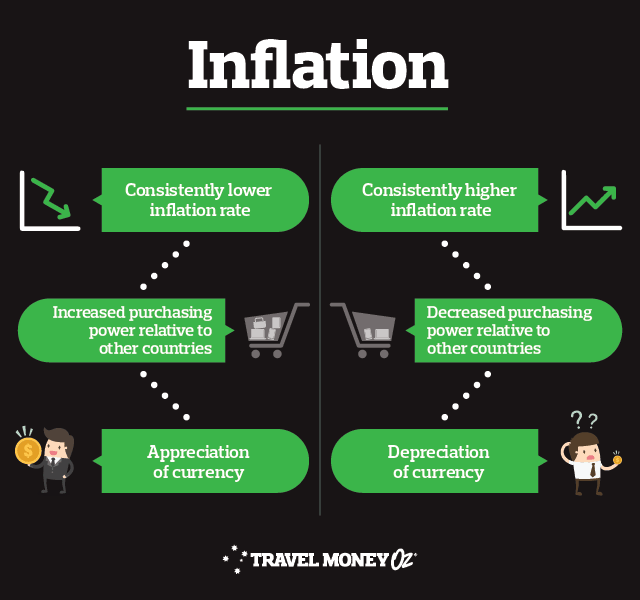

Inflation: The rate at which the general level of prices for goods and services is rising and, in turn, a currency’s purchasing power is falling. In other words, $10 back in the day used to get our grandparents dinner, dessert and a cheeky beverage or two. Now it only pays for the ice in our drink and the patronising stare of the waitor as we transfer more funds into our internet banking account.

Economic growth: The increase in an economy’s capacity to produce goods and services. Growth is generally good, but we don’t want it to be too fast. Good growth is like watching the pros do a sensual tango in Buenos Aires. Bad growth is like having one too many beers with your mates and attempting to tango at 3am in the hostel.

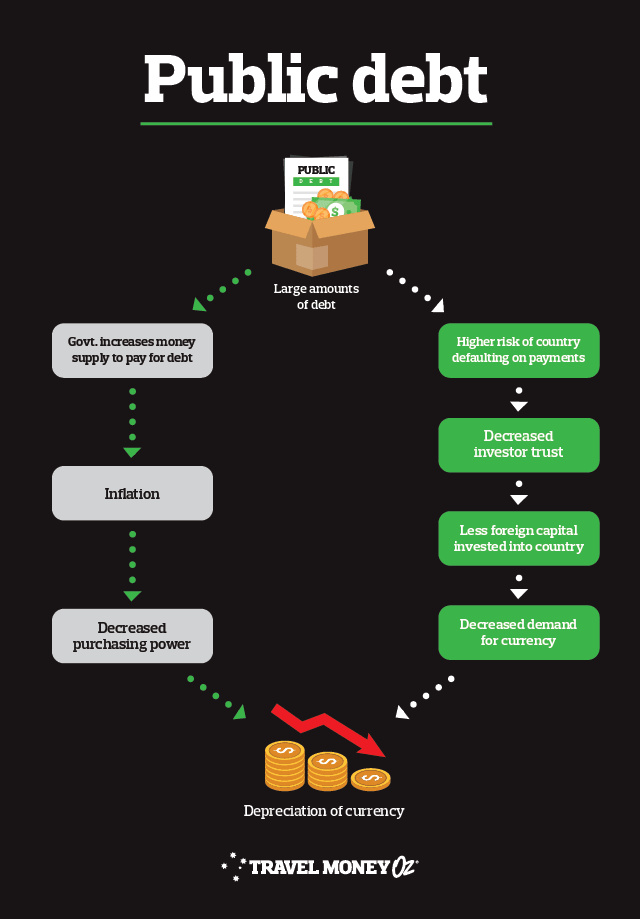

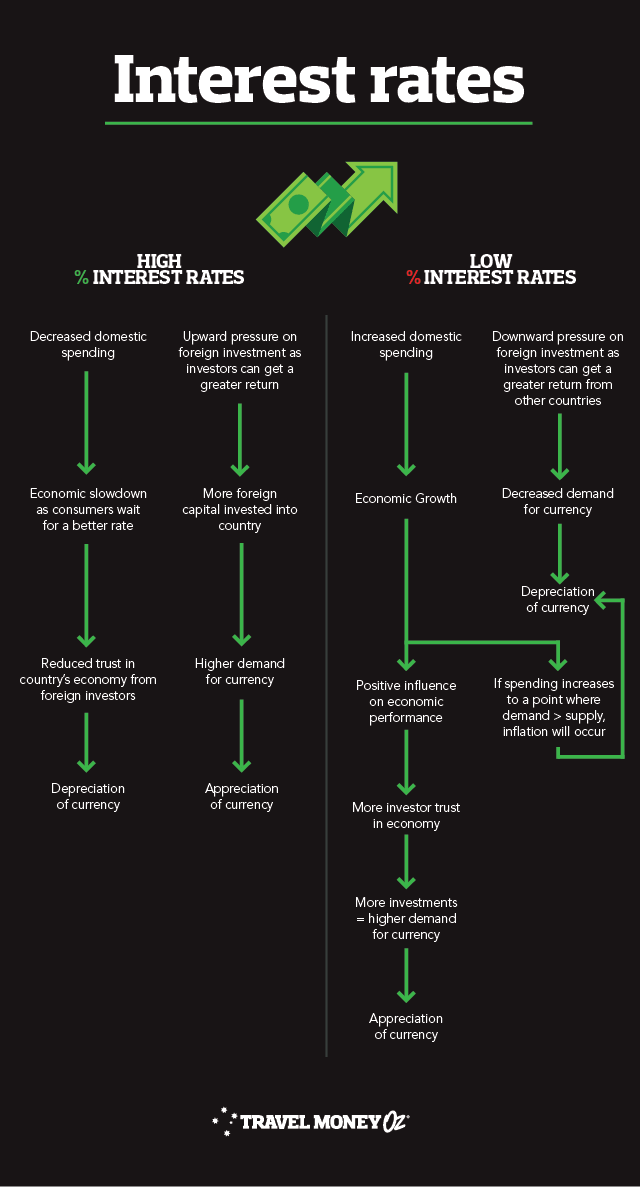

Alright, with those definitions under your belt let’s hit some infographics.

It’s important to keep in mind that, as mentioned above, AUD to ARS exchange rates are influenced by a multitude of factors. Ultimately, they sum up the supply and demand of a currency in an easy to measure metric.

Actual demand is driven by people’s perception of a currency’s value, and this perception alone is influenced by economics, politics and the media (to name just a few).

You also need to remember that the changes are relative to the other country in which the currency is being compared to. All elements interact and influence each other separately, so they must be considered all together and aligned with both countries to get a truly holistic view.

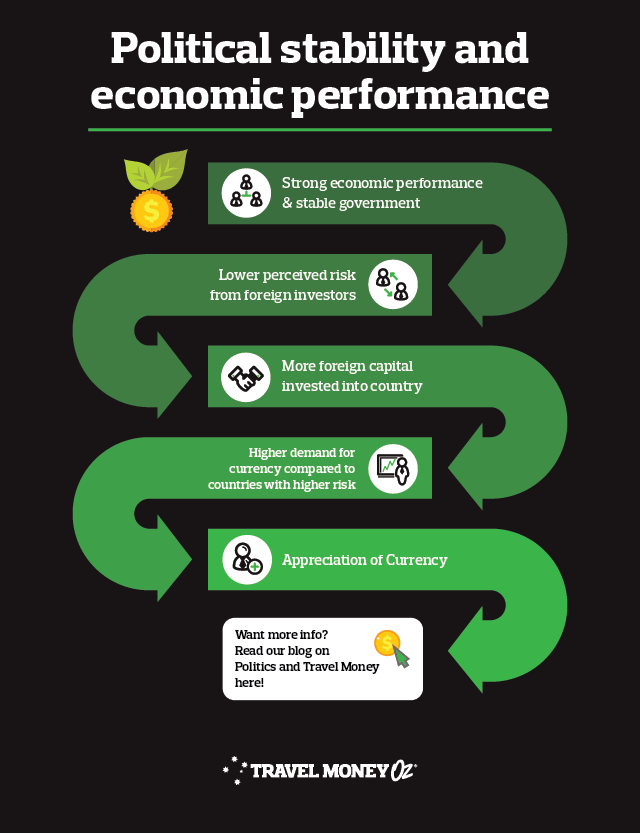

With this in mind, it is wise to keep an eye on what’s going on in both Argentina and global politics when looking at AUD to ARS predictions. A trade agreement, change in leadership or scandal can lead to a media frenzy that causes the public to potentially gain or lose trust in the economy and, potentially, put pressure on the AUD.

If all of this is just a bit too much, we’ll leave you with one final nugget of information to remember.

More trust = more people willing to invest in country = greater demand for currency = appreciation

Less trust = less foreign capital invested into country = decreased demand for currency = depreciation

From a travellers perspective, we don’t have a great deal of control over how the AUD will perform against the ARS. However, a little bit of knowledge and pre-planning can leave you with some more spending money in your back pocket. Better yet? Sign up for currency alerts and let us do the hard work for you.

Don’t stress about missing out on a better rate after purchase either! Attach Rate Move Guarantee in store and we will refund you the difference should the rate change within 14 days.

*Prices are approximations based of the difference between mean estimates for AUD to ARS in Q3 2020 and Q4 2020. Keep in mind prices may vary across states and individual vendors. Cost and quantity estimations should be used as a guide only. This blog is provided for information only and does not take into consideration your objectives, financial situation or needs. You should consider whether the information and suggestions contained in any blog entry are appropriate for you, having regard to your own objectives, financial situation and needs. While we take reasonable care in providing the blog, we give no warranties or representations that it is complete or accurate, or is appropriate for you. We are not liable for any loss caused, whether due to negligence or otherwise, arising from use of, or reliance on, the information and/or suggestions contained in this blog.