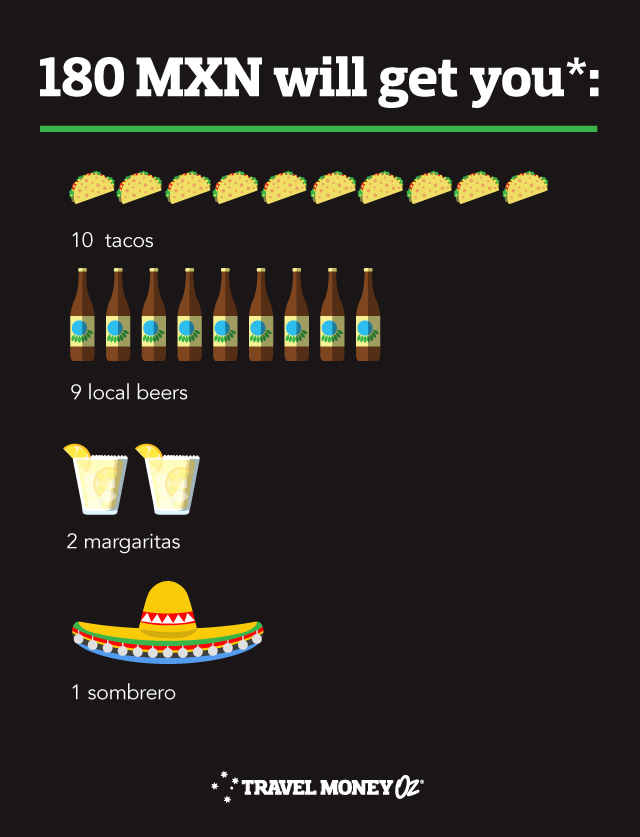

In June 2019, exchanging 2000AUD for MXN would have got you about 23,860 Mexican pesos. Exchanging the same amount eight months later in February 2020 would have only got you 21,456.40 MXN. That’s a difference of 2403.60 MXN, or about 243 freshly made, authentic tacos. Pretty crazy what the eight months can do, hey?

Foreign currency and exchange rates are kinda like a hormonal teenager – up some days and down the other, and you never really know which way they are gonna swing. At the time we can understand why rates change as they do, however no one has a crystal ball that says “travel now instead of in eight months because you’ll miss out on a lot of tacos and probably drown your sorrows in Corona’s as a result”. If you do have one, please let us know, it would make our lives a lot easier. Also I really like tacos so would be keen to maximise my AUD to taco consumption ratio in Mexico.

What we do know is that changing exchange rates can and will heavily impact your spending power overseas. While we can’t guarantee anything, it is definitely worth educating yourself on the metrics and influencing factors behind exchange rate forecasting so that you not only know the best time to travel, but also understand when to grab some foreign currency and why that is the case.

Australian dollar to Mexican peso forecasting isn’t for the faint-hearted, especially when you consider how many factors contribute to exchange rate fluctuations. However, having an understanding of what impacts forecasts can help you maximise your overseas spending money.

We’ve compiled some forecasts below to give you an idea of what to expect if you’re planning a trip to Mexico soon.

AUD to MXN Exchange Rate Forecasts

|

AUD/MXN |

Mean (of 40 bank forecasts) |

Citibank |

ING |

|||

|

Seasonality |

Q3 2020 |

Q4 2020 |

Q3 2020 |

Q4 2020 |

Q3 2020 |

Q4 2020 |

|

Exchange rate |

12.91 |

13 |

13 |

13.07 |

13.51 |

13.92 |

|

Exchange 2k in AUD |

25,820 MXN |

26,000 MXN |

26,000 MXN |

26,140 MXN |

27,020 MXN |

27,840 MXN |

|

Difference |

180 MXN |

140 MXN |

820 MXN |

|||

|

Data correct as of 4 March 2020. |

||||||

What does this mean though? Well, let’s take the mean as an example.

As you can see, while the banks can’t agree on an exact figure, all are hovering between the 12.9 – 13.9 mark. This is due to a number of reasons, however global events such as the Coronavirus and weakness in the Australian economy are definitely contributing factors.

How do banks forecast foreign currency movements?

The golden question. Short answer: they gain insight from a wide scope of information sources and make a prediction based on that. There is a multitude of data streams out there, and each financial institution has their own method of analysis. None of these are full proof though, so it’s worth considering a few AUD to MXN forecasts for a well-rounded view on when to purchase your travel money.

Think of it like this. Each bank has a full fridge of ingredients to make fish tacos; however, they all have their own ‘secret recipes’ passed down through the generations. The ingredients are the mostly the same, and they are all aiming for the same dish, however each banks version will no doubt be different from the others. Make sense?

If you wanted a thorough understanding of the metrics behind the predictions, I would recommend you enrol in a university economics degree because it’s not the kind of thing you master from a blog article or Ted talk. Alternatively, if you are just after a baseline understanding, we have thrown together a traveller friendly guide. At its core, you just need to get a solid understanding of the relationship between macroeconomic fundamentals and exchange rates.

Get started with a few key definitions.

Appreciation: When the value of one currency increases relative to another. E.g. If the AUD went from 12.91 to 13 MXN it has appreciated (this means more tacos for you).

Depreciation: Surprise surprise, this is when the value of a currency decreases relative to another. E.g. If the AUD went from 13 to 12.91 MXN (less tacos and more sadness).

Higher valued currency: Cheaper imports (no more abandoning that online shopping cart), more expensive exports and extra spending money in for Coronas and sombreros.

Lower valued currency: More expensive imports, cheaper exports and less cash for your Mexican adventure.

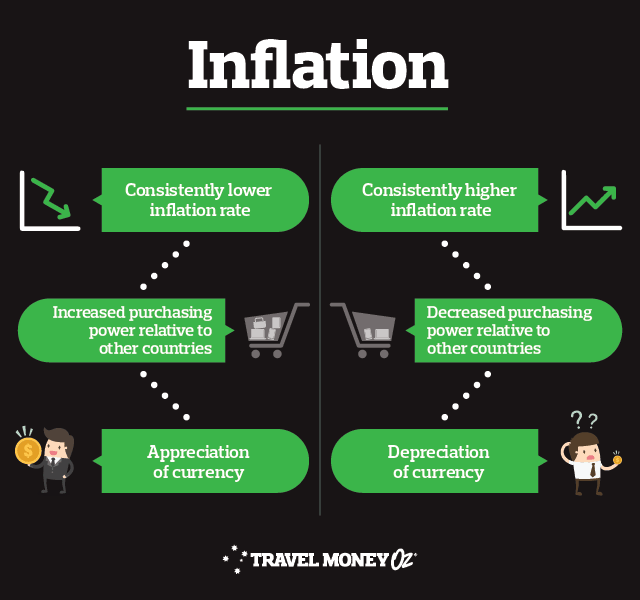

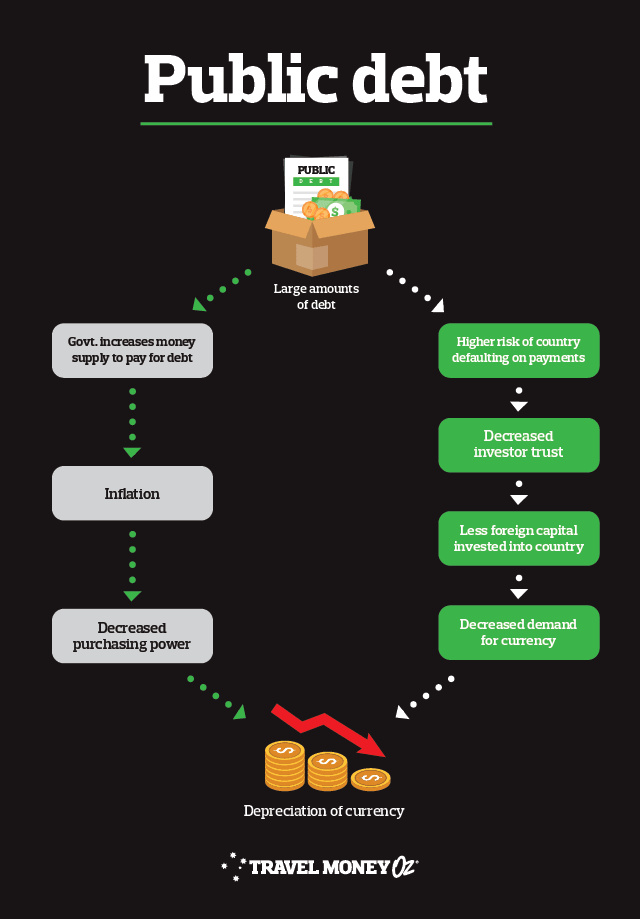

Inflation: The rate at which the general level of prices for goods and services is rising and, in turn, a currency’s purchasing power is falling. In other words, $10 back in the day used to get our grandparents dinner, dessert and a cheeky beverage or two. Now it only pays for the ice in our drink and the patronising stare of the waiter as we transfer more funds into our Internet banking account.

Economic growth: The increase in an economy’s capacity to produce goods and services. Growth is generally good, but we don’t want it to be too fast. Good growth is like dabbling in some different hot sauces to build up your tolerance over a two week Mexican trip. Bad growth is like doing a shot of ultimate death heat hot sauce on your first night and passing out from the pain on your hostel bed. A sweaty, sweaty mess.

Alright, with those definitions under your belt let’s hit some infographics.

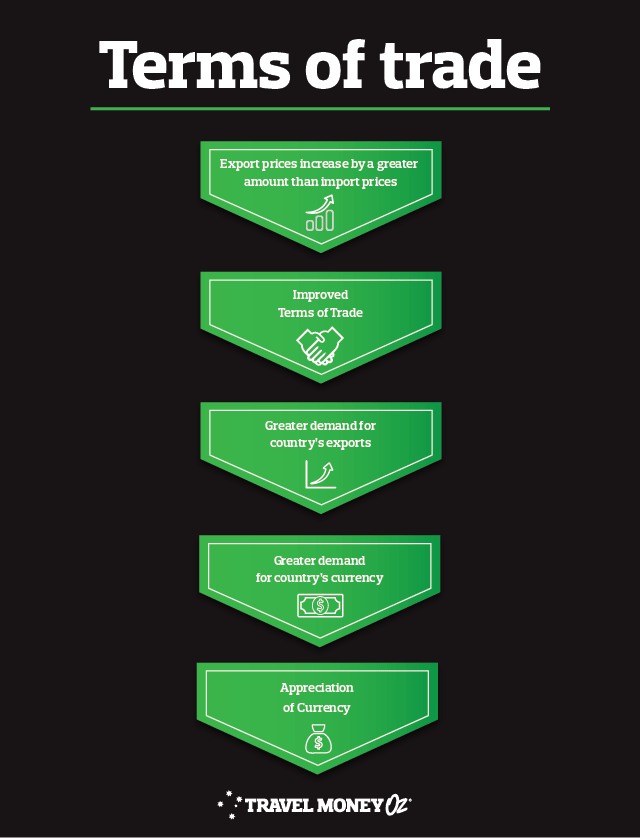

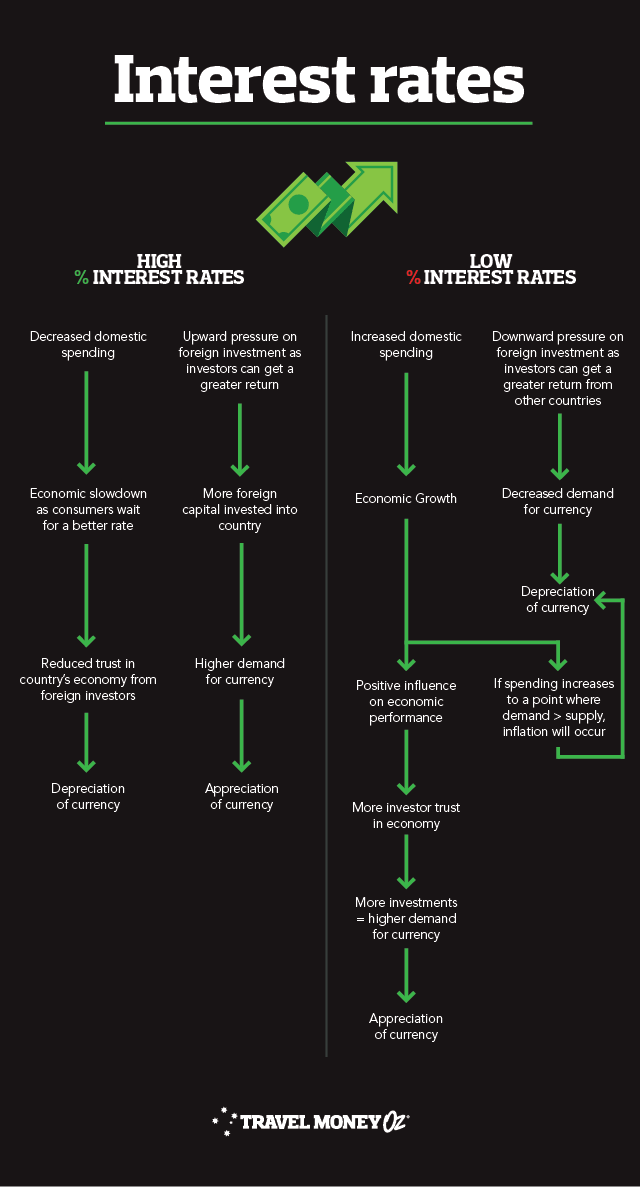

It’s important to keep in mind that, as mentioned above, AUD to MXN exchange rates are influenced by A LOT. Ultimately though, they sum up the supply and demand of a currency in an easy to measure metric.

Actual demand is driven by people’s perception of a currency’s value, and this perception alone is influenced by economics, politics and the media (to name just a few).

You also need to remember that the changes are relative to the other country in which the currency is being compared to. All elements interact and influence each other separately, so they must be considered all together and aligned with both countries (in this case Australia AND Mexico) to get a truly holistic view.

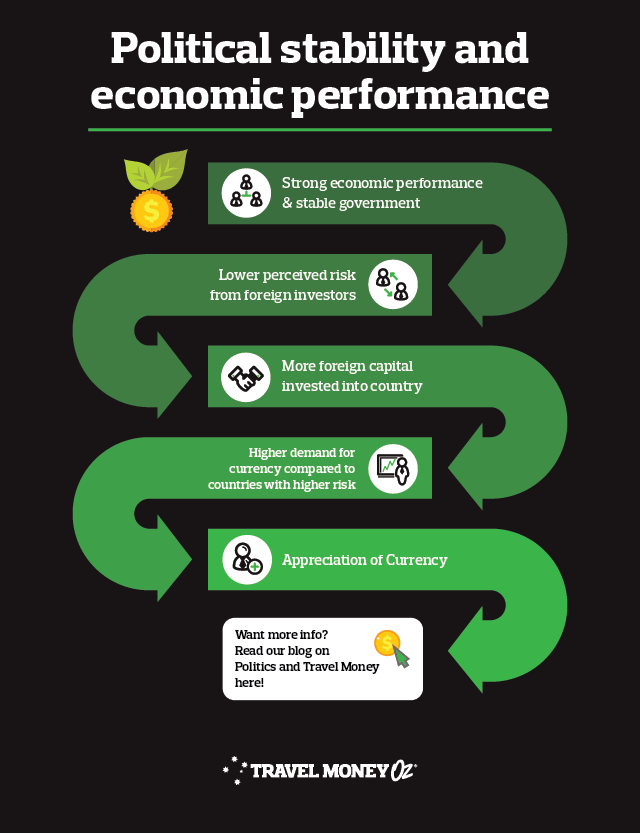

With this in mind, it is wise to keep an eye on what’s going on in both Mexico, the USA and global politics when looking at AUD to MXN predictions. A trade agreement, change in leadership or virus can lead to a media frenzy that causes the public to potentially gain or lose trust in the economy and, potentially, put pressure on the AUD against the MXN.

If all of this is just a bit too much, we’ll leave you with one final nugget of information to remember.

More trust = more people willing to invest in country = greater demand for currency = appreciation

Less trust = less foreign capital invested into country = decreased demand for currency = depreciation

From a travellers perspective, we don’t have a great deal of control over how the AUD will perform against the MXN. However, a little bit of knowledge and pre-planning can leave you with some more spending money in your back pocket and a tummy full of tacos in Playa del Carmen. Better yet? Sign up for currency alerts and let us do the hard work for you.

*Prices are approximations based of the difference between mean estimates for AUD to MXN in Q3 2020 and Q4 2020. Keep in mind prices may vary across regions and individual vendors. Cost and quantity estimations should be used as a guide only. This blog is provided for information only and does not take into consideration your objectives, financial situation or needs. You should consider whether the information and suggestions contained in any blog entry are appropriate for you, having regard to your own objectives, financial situation and needs. While we take reasonable care in providing the blog, we give no warranties or representations that it is complete or accurate, or is appropriate for you. We are not liable for any loss caused, whether due to negligence or otherwise, arising from use of, or reliance on, the information and/or suggestions contained in this blog.