Speaking of the lower cost of living, just how much cheaper are things in India compared to Australia? Well, according to Numbeo data the cost of living in India is 66.07% lower than in Australia. That’s great if you’re on a budget and want to splurge at the markets or treat yourself to an Indian banquet or 2. To give you an idea by what we mean when we say the cost of living is lower, this is what you can expect to pay for some standard items in India:

Bottle of water (don’t forget to stay hydrated) – 28 INR (0.58AUD)

3 course meal for 2 – 700 INR (14.50AUD)

A half litre beer – 120 INR (2.50AUD)

Month pass on the train – 650 INR (13.50AUD)

With things being so cheap in India compared to Australia, every rupee you save by doing your homework on exchange rates is going to give you extra bang for your buck.

Let’s see what the economic boffins think the AUD/INR forecast has in store for it shall we...

AUD to INR Forecasts

|

AUD/INR

|

Mean (of 41 bank forecasts)

|

Citigroup

|

Westpac

|

|

Seasonality

|

Q2 2020

|

Q3 2020

|

Q2 2020

|

Q3 2020

|

Q2 2020

|

Q3 2020

|

|

Exchange rate

|

48.81

|

49.08

|

50.94

|

51.99

|

47.39

|

47.57

|

|

Exchange 2k in AUD

|

97,620 Rs

|

98,160Rs

|

101,880 Rs

|

103,980 Rs

|

94,780 Rs

|

95,140 Rs

|

|

Difference

|

540 INR

|

2100 INR

|

360 INR

|

|

Data correct as of 17 February 2020.

|

As you can probably tell, despite having most of the same data at their fingertips, the banks don’t always agree on what’s in store for the AUD/INR in the short-medium term.

Citibank is obviously more bullish on the AUD in Q2/20 and Q3/20 than Westpac and the mean of 41 different banks. Exactly why Citibank sees the AUD performing higher against the INR would be in the secret herbs and spices of their in-house brainiacs’ and robots way to complicated currency exchange algorithms.

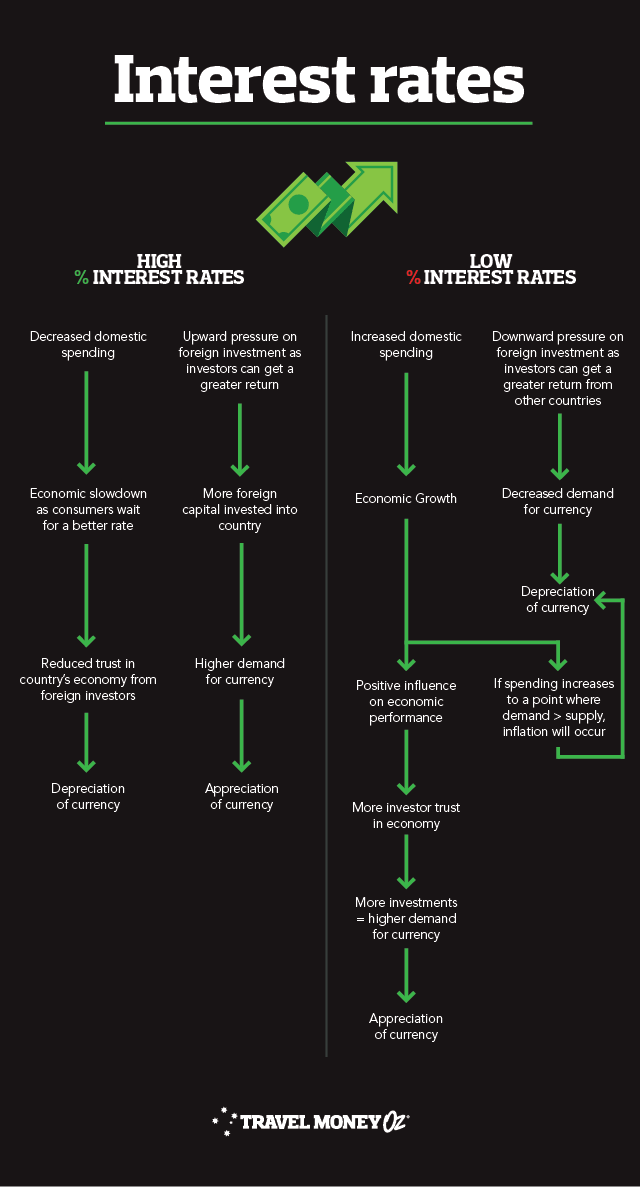

Banks and economists use dozens of different sets of data and other sources of information to put together their forecasts, but with a little bit of research and putting 2 and 2 together Aussie travellers can get a pretty good insight into the dynamics affecting fluctuations in the value of the AUD against the INR. The first step is to get an understanding of the technical jargon economists use along with the macroeconomic fundamentals and their influence on exchange rates.

Appreciation

When the value of one currency increases relative to another. E.g. When the AUD goes from 47 INR to 49 INR it has appreciated. Travellers appreciate this too, because it means more spending money and who doesn’t appreciate that?

Depreciation

Is when the value of a currency decreases relative to another. E.g. When the AUD drops from 49 INR back to 47 INR it has depreciated and you are depressed.

Higher valued currency

Cheaper imports (no more abandoning that online shopping cart), more expensive exports and extra spending money at the markets.

Lower valued currency

Means more expensive imports, cheaper exports, more people overseas and less cash for your Indian adventure.

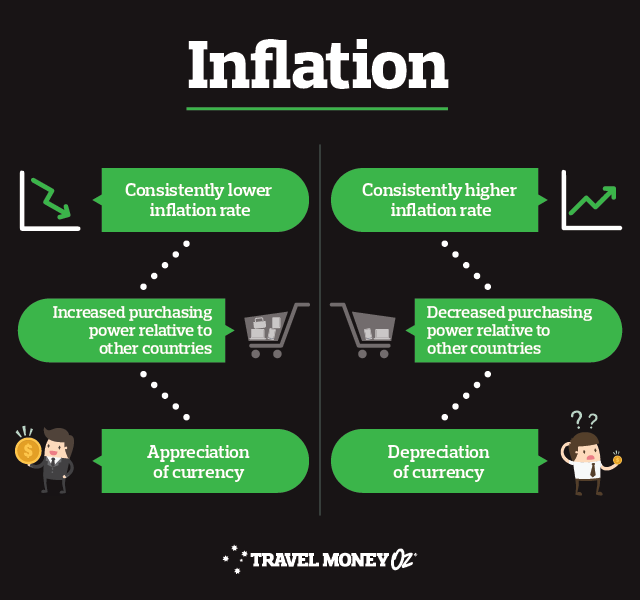

Inflation

The rate at which the general level of prices for goods and services is rising and, in turn, a currency’s purchasing power is falling. In other words, $10 back in the day used to get you a lot more than it does now - over time the value of a currency decreases as a result of supply and demand.

Economic growth

The increase in an economy’s capacity to produce goods and services. Growth is generally good, but we don’t want it to be too fast.

Bearish vs Bullish

Refer to currency or equity markets and the general sentiment of the people that trade in them. A bull market is when the buyers are optimistic about the rise in the prices of shares or currency and bulls are people spruiking a market as being in this positive zone. When a bull is angry and attacks, it uses its horns in an upward goring manner, that’s why a bull market is one that is going up. Bear markets are full of pessimism and dropping value in currency or stocks and bears are the doomsayers (or realists) during these times. Bears swipe down when they attack, that’s why bear markets are going down.

Survived the Bull and Bear attack? Good, now it’s on to the trickier stuff. Hold on tight, these are the things that really stir up foreign exchange markets and affect currency forecasts.

Don’t worry, there’s no pop quiz after all that. The main thing to remember is that a lot of things go into forecasting foreign exchange rates and a multitude of factors can give a currency a boost upwards, or a sharp fall downwards and not everyone gets it right.

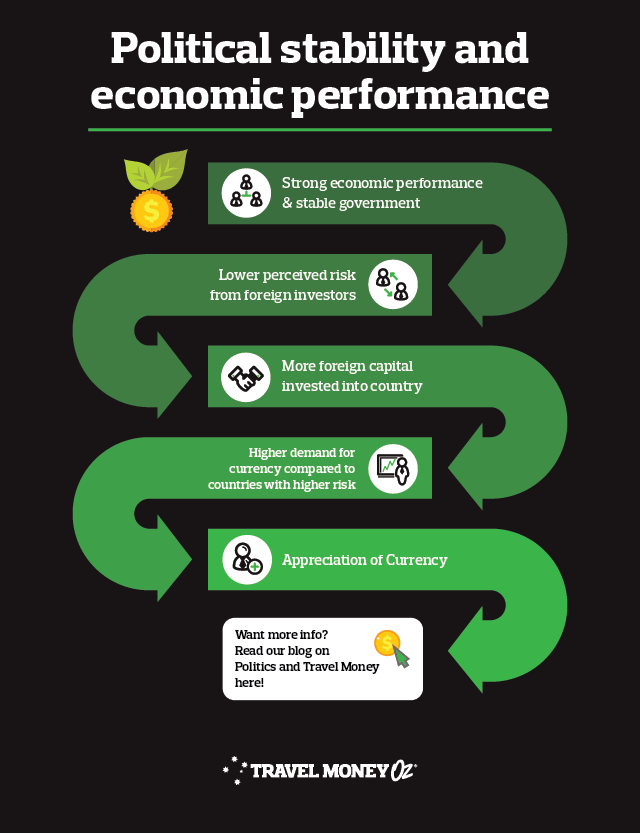

One of the biggest and most important to identify drivers of a currency’s value is consumer sentiment. Consumer sentiment is a reflection of the broader economic climate and how the market views a currency. The more confidence investors have in an economy the better the currency usually performs. Events such as knifing Prime Ministers, Trade Wars, dropping interest rates and natural disasters can all have a major effect on consumers’ confidence in both the country and the currency. Think of it like this:

More trust = more people willing to invest in country = greater demand for currency = appreciation

Less trust = less foreign capital invested into country = decreased demand for currency = depreciation

Still don’t feel like you’ve got it all? Don’t worry. We’ll do all the hard work while you relax and we’ll let you know when the AUD hits your preferred INR rate, just sign yourself up for our Rate Alerts. When you do bite the bullet and exchange your precious Aussie dollars, don’t forget to add Rate Move Guarantee to your transaction in store to protect yourself and your back pocket from any quick drops in currency value. It’s free and will protect you against exchange rate movements within 14 days of purchase, we refund you the difference. How good is that?

*Prices are approximations based on the difference between mean estimates for AUD to INR in Q2 2020 and Q3 2020. Keep in mind prices may vary across states and individual vendors. Cost and quantity estimations should be used as a guide only. This blog is provided for information only and does not take into consideration your objectives, financial situation or needs. You should consider whether the information and suggestions contained in any blog entry are appropriate for you, having regard to your own objectives, financial situation and needs. While we take reasonable care in providing the blog, we give no warranties or representations that it is complete or accurate, or is appropriate for you. We are not liable for any loss caused, whether due to negligence or otherwise, arising from use of, or reliance on, the information and/or suggestions contained in this blog. Terms and conditions apply to Rate Guard. See travelmoney.co.nz/rate-guard for more details.